By Maria Serenade Sinurat, Sieska Sumendap, and Elwyn Panggabean

In a busy corner of a Jakarta suburb, Atin, 36, keeps a steady rhythm. Between racks of clothes and shelves of beauty products, she runs a physical store with six employees and manages three online stores. Orders come in throughout the day, some from loyal shoppers, others from new customers scrolling through their feeds. It’s a fast-paced, sometimes unpredictable routine, but Atin sees momentum building. She’s working toward launching her own brand, one step at a time. Her story reflects the daily reality of many Indonesian women entrepreneurs: adapting, planning ahead, and steadily carving out a space in a fast-moving digital marketplace.

This shift is mirrored in Indonesia’s expanding e-commerce market, expected to reach $169 billion by 2032, with women contributing an estimated $74 billion. More than just an economic trend, it marks a step forward in women’s financial inclusion and independence. As highlighted in UNEP FI’s Gender Equality Guidance, financial services designed with women’s needs in mind can strengthen their ability to manage uncertainty and build long-term resilience.

Recognizing this, Women’s World Banking has partnered with SeaBank Indonesia since 2024 to develop women-centered financial products. By addressing barriers like low awareness, safety concerns, and poorly targeted messaging, the partnership aims to make digital banking more accessible and relevant for women.

Understanding women entrepreneurs

Women own 64% of Indonesia’s MSMEs and generated 35% of online commerce revenue pre-pandemic, yet still earn 22% less than men and often lack confidence in financial management (McKinsey).

SeaBank supports over one million shops, with 45% women-owned; however, many women use accounts only for payment reception rather than comprehensive financial services.

Our research identified three primary profiles of women e-commerce entrepreneurs:

- Pure-digital strategists: Online-native sellers who save strategically for business expansion and emergencies.

- Hybrid commerce sellers: Disciplined savers who use time deposits for both business and family needs.

- In-store innovators: Transitioned from offline to online, regularly saving through diversified methods, including assets like gold.

Despite differing habits, all prioritize security, convenience, cost-effectiveness, ease-of-use, and relevance in financial services. Providers must thus offer tailored services, reduced transaction fees, and simplified account processes to attract and retain women entrepreneurs.

Designing a financial solution for women

Based on these insights, SeaBank is addressing the specific challenges that prevent women e-commerce sellers from using its digital savings solutions. The goal is to help women manage their business finances more effectively, while positioning SeaBank as a trusted financial partner. It also encourages women to adopt good financial practices in both their business and personal lives, helping them to build stronger financial resilience.

The solution is grounded in four women-centered design strategies:

1. Design for cognition: enhancing awareness

Many women sellers are unfamiliar with digital banking tools or unsure of their relevance. We simplify financial language into relatable messages and ensure consistent communication across platforms women already use. Visuals and wording are crafted to resonate specifically with women entrepreneurs.

Examples of practice:

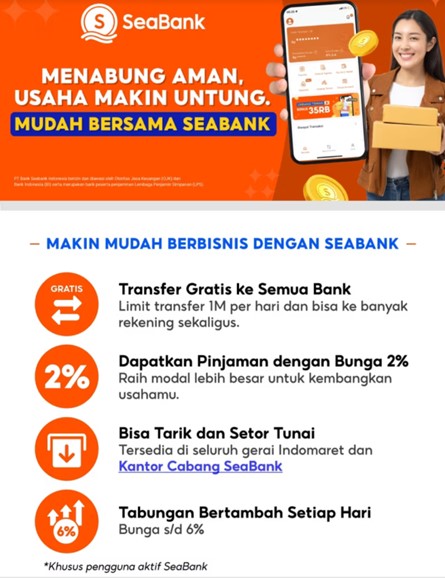

- Updated marketing materials that highlight the convenience and cost benefits of SeaBank’s mobile banking features

- Clear in-app messaging across SeaBank’s digital ecosystem, positioning the app as a comprehensive financial tool—not just a payment gateway

Marketing assets that attract women customers

2. Design for trust: building credibility

Security and reliability are top concerns. To address this, we showcase real experiences of women MSME owners who use SeaBank, reinforcing trust through authentic testimonials.

Examples of practice:

- Sharing testimonial videos through social media and seller communities

- Featuring trusted symbols such as the OJK and LPS logos, and promoting SeaBank’s responsive contact center for issue resolution

3. Design for accessibility: driving engagement

Women’s engagement with financial services can be increased by making features intuitive, rewarding, and relevant to their everyday needs.

Examples of practice:

- Gamified features tied to daily financial activities (such as payments and withdrawals) to make learning and using the app engaging and familiar

- Sub-accounts that help separate business and personal finances, supporting clearer mental budgeting and savings habits

- Online and offline training sessions that cover financial and business topics, building confidence and skills to manage business growth

4. Design for use: encouraging digital savings

We support women in moving from informal to digital savings by making their progress visible and actionable. Real-time tracking builds a sense of control and motivation to save consistently.

Examples of practice:

- Automated reports that show total savings and fee-free transactions, helping women visualize their financial progress and the value of digital banking

Taking women entrepreneurs to the next level

Our work with SeaBank highlights how gender-intentional design helps women entrepreneurs become more resilient and ready for growth.

- Better financial management

Women e-sellers highly valued our interactive training sessions, with 100% finding them effective and recommending them to their peers. These sessions equipped sellers with practical skills to manage their finances and grow their businesses.

- Increased account engagement

Women-centered designs led to increased account activity, with up to 19% more sellers actively making withdrawals after receiving personalized savings reports during our pilot with around 700 women sellers. This engagement means that women access and control their savings more regularly, which directly builds their financial resilience by helping them to better cope with financial shocks and uncertainties.

Our pilot with SeaBank clearly demonstrates that thoughtful, tailored solutions can significantly improve the way women entrepreneurs use financial services to grow their businesses. To further empower women entrepreneurs, financial institutions must continue to innovate and offer targeted solutions that help women reach the next level of business success. This will create stronger, lasting relationships that benefit both women entrepreneurs and financial service providers.

This publication is funded by (or in part by) the Gates Foundation. The findings and conclusions contained within are those of the authors and do not necessarily reflect positions or policies of the Gates Foundation.