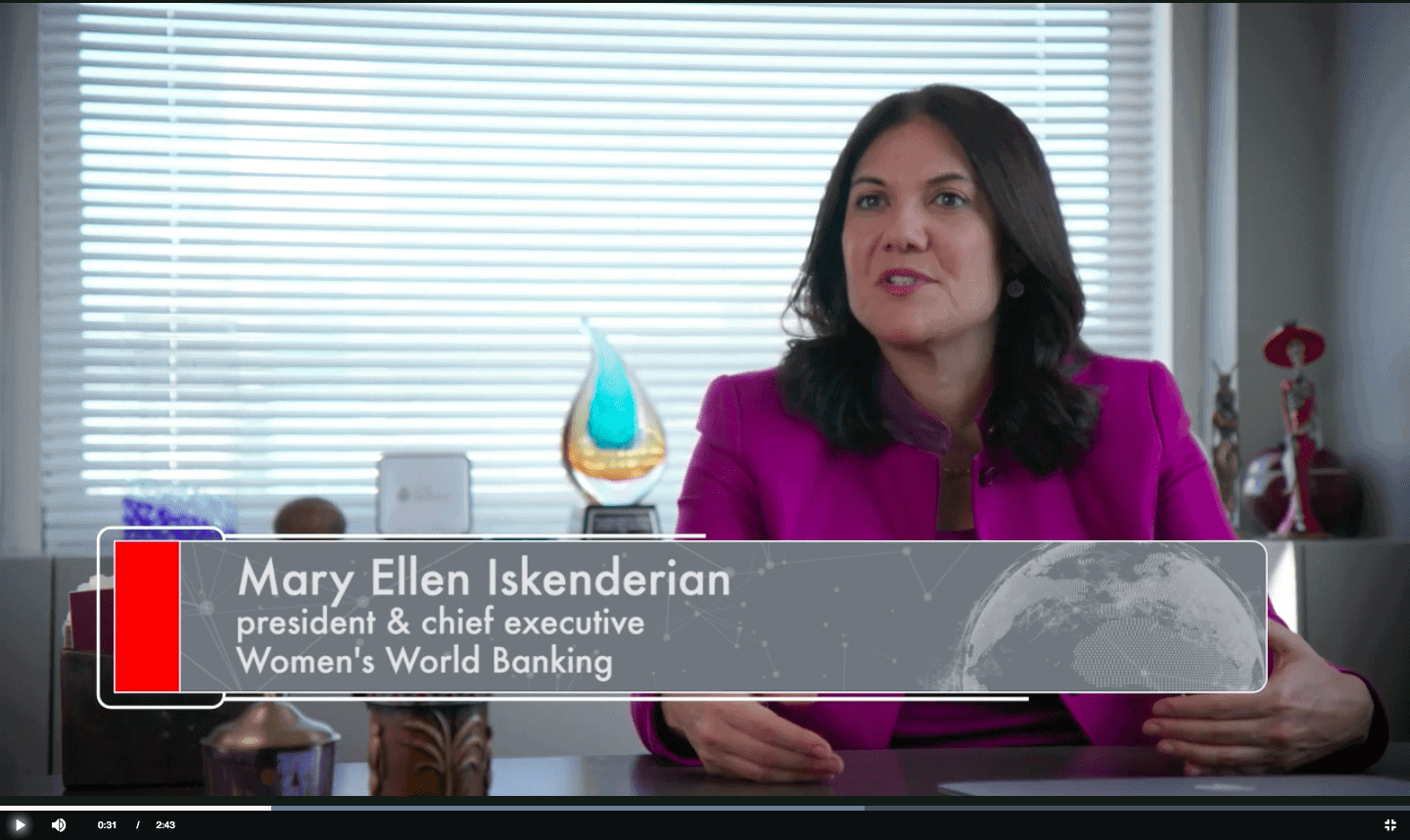

Empowering Women, Building Trust: A Case Study of a Women-Centric Insurance Solution in Nigeria

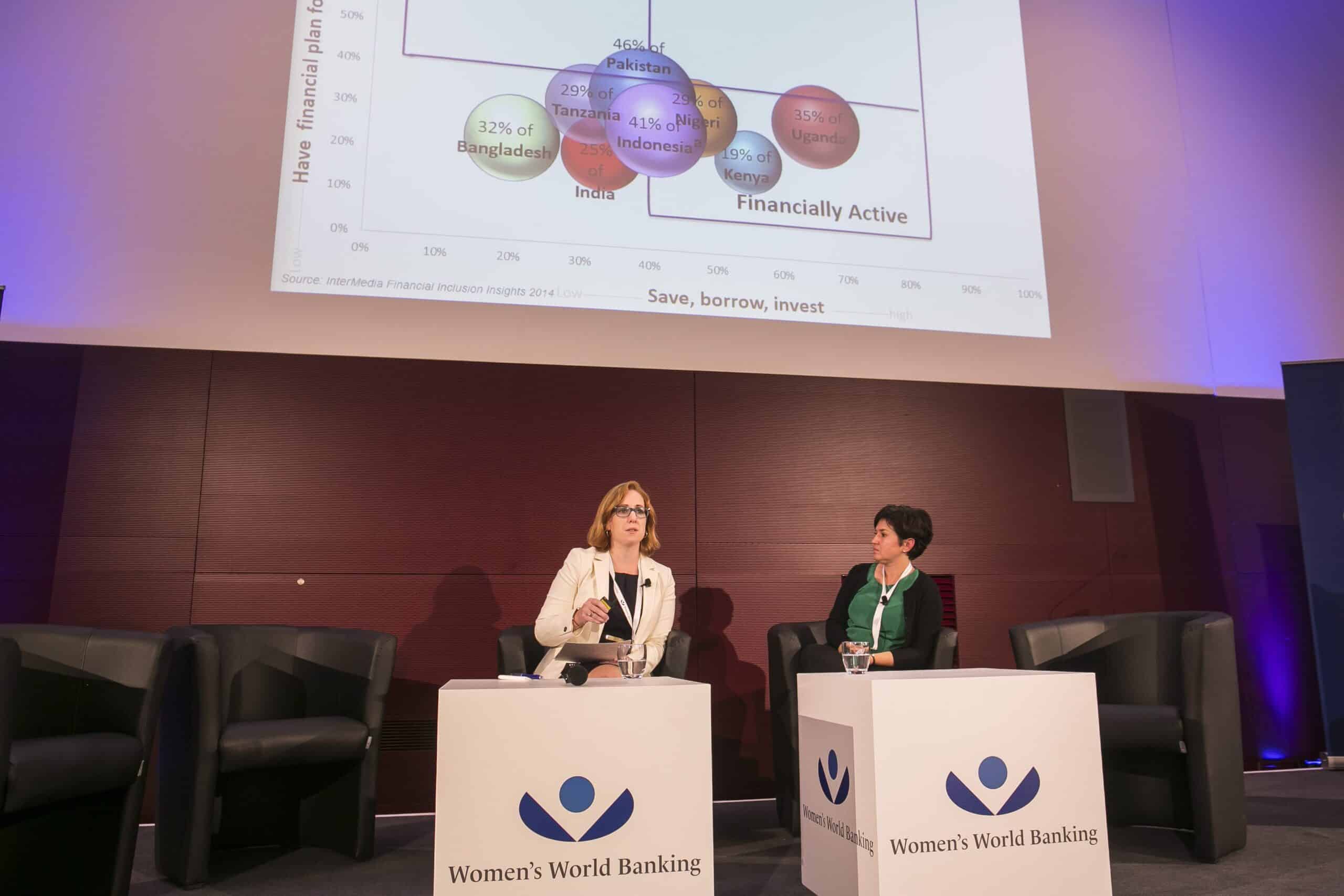

Meet Ruth. She is a 26-year-old Nigerian woman and the owner of a mini pharmacy in Ilesha town in southwestern Nigeria. Ruth, like many other Nigerian women, is particularly vulnerable to health risks and faces gender-specific challenges related to maternity. According to the latest Findex, sixty-two percent of Nigerian women