This blog summarizes findings from a new Women’s World Banking research report available here.

In India and Indonesia, women have long battled a litany of challenges to start and expand their own businesses. Constraints related to low access to capital, restricted mobility, limitations on property rights, time poverty, and gender norms discouraging work outside the home disproportionately affect women. As a result, in India, women own less than 10 percent of all micro-enterprises (4.6 million) and in Indonesia, women own about 25 percent of all micro-enterprises (14.7 million), and most women-owned businesses in both countries are micro in scale.

However, as described in Women’s World Banking’s new publication, “Social commerce entrepreneurship and new opportunities for women’s financial inclusion in India and Indonesia,” as the internet becomes more and more a part of people’s lives around the world, what is needed to start and run a business is changing. India and Indonesia have made tremendous strides in smartphone ownership and internet connectivity, and in both countries ecosystems of formal and informal e-commerce have flourished in the past few years. Micro-enterprises are starting to adopt a suite of digital platforms available to take their business online, from social media and messaging, digital payments, online marketplaces, and delivery services, to buy and sell goods and services. The centrality of social media to low-income internet users’ lives has led to a name for this type of business: “social commerce” entrepreneurship.

In moments of dramatic digital transformation such as this, there can be important differences in how men and women are able to take advantage of technological change. Are women on board or left behind, and going forward, how can we shape this current of change to include and empower women?

We saw substantial promise in online business to increase women’s business growth and access to formal financial services, including digital payments and credit. But we also wondered how women would overcome well-documented barriers to digital inclusion, where gender gaps in smartphone ownership of 58 and 21 percentage points persist in India and Indonesia, respectively.

With support from Standard Chartered and the Australian Department of Foreign Affairs and Trade, we conducted mixed methods research in India and Indonesia: surveys with over 1200 women business owners and semi-structured interviews with 30 women respondents in each country. The final report is now available online. To take stock of current trends and look towards future opportunities, our research was driven by the following questions:

- How are low-income women currently engaging in social commerce?

- What drives successful adoption of online platforms among women micro-entrepreneurs?

- How are women’s business and financial needs and aspirations changing, and how does this create new opportunities to support their businesses growth and financial inclusion?

How are women engaging in social commerce?

The first insights from the research illustrated that the customer journey of social commerce was not quite as we had imagined. Social media is often but not always the first rung in the ladder of online business. Some entrepreneurs in India, for example, adopted e-commerce platforms to purchase supplies delivered to their small grocery store in bulk, and were not interested in using social media to acquire new customers. Personal or consumer use of a platform is a common gateway to start using it for business purposes, and this is true for social media as well as digital payments and e-commerce platforms. A strong use case and appropriate support can drive adoption of platforms in any sequence.

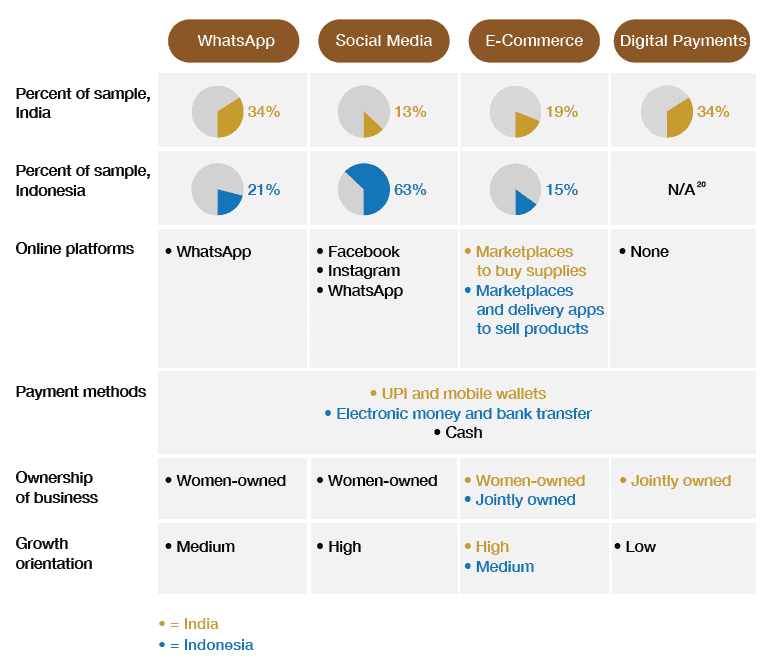

In our sample, we identified four key customer segments, defined by the mix of platforms they use: Whatsapp-only users, social media users, e-commerce users, and digital payment-only users. Each have different aspirations for their business, levels of digital literacy, and joint vs. independent ownership.

Our data show that women entrepreneurs frequently draw on different platforms to complete a transaction with a single customer. For example, in Indonesia, a customer may express interest on Facebook, coordinate product details over Whatsapp, arrange a delivery service to receive the product, and make the payment in cash, bank transfer, or digital payment. In addition, all segments, including digital payment users, continue to transact in cash alongside other options like bank transfer and digital payments. E-commerce platforms in both countries have cleverly allowed for users to do cash-on-delivery or offline-to-online transactions with an agent, blending the ease of online business with the confidence of cash payment. However, further improving integration of marketing, customer engagement, delivery, and payments could enhance women’s access to features that protect buyer and seller, save time, increase revenues, and expand access to financial services through transaction data.

What drives adoption of online platforms among women micro-entrepreneurs?

In both countries, door-to-door recruitment by sales representatives has been tremendously successful to on-board new merchants onto e-commerce and digital payment apps. In the “assisted adoption” model, representatives help merchants download the app, link to their bank account, get a QR code, and often return later to provide additional support. Women cited these in-person touchpoints as key in helping them learn how to use these platforms and gain confidence. Trusted family members and friends can also be key allies in support of women’s adoption of new technologies.

However, the assisted adoption model could be improved by 1) clarifying redress mechanisms, registration processes, and dispute resolution options, which prevent some women from adopting new platforms, and 2) leveraging in-person, peer support through referral or peer ambassador programs to reach women who work from home and are currently left out of this model.

How are women’s business and financial needs and aspirations changing, and how does this create new opportunities to support their business growth and financial inclusion?

We find that additional capacity building could help women fully utilize existing platforms. Online marketing is still a challenge with low phone storage space and camera quality. We learned about an innovative book resale company in Indonesia who had created a WhatsApp group to push out video trainings on online marketing to its network of resellers. Other supply chains that rely on women retailers may also benefit from communicating and providing training at scale through online channels.

In addition, adjustments to existing platforms could bring powerful change to women’s businesses and financial lives. First, we find that many women use platforms for both personal and business purposes, making business accounting and recordkeeping difficult. Tagging transactions and helping women use these transactions as the basis for business management decisions would be valuable as their businesses expand. WhatsApp Business would be helpful for these purposes, but was not yet adopted by respondents in our sample.

Second, many women run business jointly with their husband or other family member. However, e-commerce and digital payment platforms largely link to one bank account and one SIM card. In jointly managed businesses, this is more likely to be the husband’s (or joint) bank account and SIM. In these cases, because they cannot be formally registered on the account, women lose visibility into the business’s transactions, face inefficiencies, and miss the opportunity to build their own transaction history and financial management experience. Some women may want joint accounts with their husband and others may prefer to open their own account. A 30-year-old WhatsApp entrepreneur had just opened her first bank account a week prior to being interviewed in order to register her own Google Pay account. Ideally, both options would be accessible to women, allowing them the choice. Companies in this space should recognize the value of promoting women’s account ownership rather than access, so they can directly serve and communicate with the actual user.

Finally, while most of our sample had access to a bank account, women micro-entrepreneurs remain highly credit-constrained. As women increasingly transact digitally with their customers and suppliers, transaction data of payments and expenses will be a valuable input for financial service providers (FSPs) in assessing women’s creditworthiness, managing risk, improving underwriting and offering more customized loans. FSPs could use these platforms for customer discovery and these platforms may start accepting loan repayment installations. However, clients need to be able to provide informed consent of the use of their data for such purposes, and measures must be taken to ensure client data security and confidentiality.

Growing with women micro-entrepreneurs

Women micro-entrepreneurs in India and Indonesia are adopting a variety of digital platforms and their businesses are undergoing substantial change as a result. However, the digital transition is far from complete. There are still critical unmet needs to enhance entrepreneurs’ full use of digital platforms, reduce cash pain, increase efficiency, ensure safety and security, and enable women’s control over their own earnings and financial decisions.

Given how rapidly evolving these ecosystems are in countries like India and Indonesia, they remain highly competitive for both micro-enterprises and the new companies jostling to capture this growing segment:

For social commerce entrepreneurs to stay competitive, they must address new business challenges around acquiring new customers; staying top-of-mind and maintaining relationships with existing customers; adapting to customers’ shifting preferences around products, platforms, and payment methods; expanding and diversifying product offerings; differentiating their businesses with quality marketing; and increasing business efficiencies and mitigating risk, especially in payment and delivery interactions with both customers and suppliers.

For e-commerce, social media, digital payment, delivery, and financial service companies to remain competitive, there are critical opportunities at this point in time to support women micro-entrepreneurs to adopt and fully leverage digital platforms for their business, and to provide new financial services that help these entrepreneurs thrive. The better they address the needs and aspirations of this segment, the more they likely they will be to retain these customers and grow with the sector.

To access our full research findings, please find the final research report here.

Author: Sophie Theis, Qualitative Research Specialist

Contact: st@womensworldbanking.org