By Angela Ang, Elwyn Panggabean, Ker Thao, and Razaq Manan

It’s a beautiful Tuesday afternoon.

Irma* is cleaning her sister’s house, while also looking after her four-year-old son. She is worried whether this week’s income from cleaning sufficient to cover her household expenses. Her husband, a local fisherman, gave her Rp 200k for the month, but his income has decreased significantly since COVID. It’s now up to her to ensure her family has enough to eat and can pay the monthly rent. Irma may need to borrow from her sister again to cover rent for this month. At times like these, she wishes she had some savings.

“Why don’t you get additional job?” her sister suggested. It’s certainly crossed Irma’s mind, but who would look after her young son?

She is eagerly awaiting a funds transfer from her brother, who works in Malaysia. He normally sends it to her sister’s account, but Irma wishes she could use her PKH BRI account to receive the transfer; that way, she wouldn’t have to rely on her sister to withdraw her funds. Although she has heard that such a transaction is possible, she is unsure of how and afraid that she wouldn’t be able to withdraw funds from the PKH BRI account. That’s why she only uses the account to withdraw the PKH disbursement—and even then, she relies on her peer group leaders to handle the withdrawals.

“Can I use the PKH BRI account to receive transfers from my brother? Would this disqualify me from receiving funds from the PKH program?” All these questions make her feel overwhelmed,, but she has finally decided to raise them with her peer group leaders at their next meeting.

Irma is one of 10 million beneficiaries of Program Keluarga Harapan (PKH), an Indonesian government-to-person (G2P) program. In 2017, PKH transitioned from cash to digital payments, enlisting four state-owned banks, including Bank Rakyat Indonesia (BRI), through a basic savings account (BSA). BRI is a state-owned and the largest bank in Indonesia that has a large customer base among the low-income population. With 3.7 million PKH beneficiaries in their portfolio and over 500,000 BRILink agents scattered throughout Indonesia, BRI is an important player in driving Indonesia’s financial inclusion, including account engagement amongst the PKH beneficiaries.

Irma’s experience is one of many stories among PKH beneficiaries who have not actively used their PKH accounts effectively. Despite having access to formal financial services through their G2P account, low account usage hinders many individuals from experiencing the wide range benefits associated with these services.

Women’s World Banking saw an opportunity to collaborate with BRI to address this issue by designing an account activation solution among the PKH women beneficiaries, beyond G2P transactions.

Customer barriers to account usage

Through in-depth customer research, we wanted to understand the financial needs, behaviors and practices among women beneficiaries. This included assessing how they currently use financial tools and the challenges that prevent them from leveraging their PKH BRI account actively. Irma and her fellow beneficiaries’ stories helped us identify key barriers to account usage:

- Lack of account awareness and capability: Insufficient account education and strategies to improve skills and confidence to conduct transactions limits PKH beneficiaries’ knowledge and capability to use the account.

- Inconsistent message by different PKH touch points: Aside from the PKH beneficiaries, relevant stakeholders such as PKH facilitators, or bank agents, have varying levels of knowledge of the account, which creates confusion and hesitancy among the beneficiaries.

- Misconceptions and myths around PKH account: Myths circulating amongst G2P beneficiaries fuel mistrust and confusion around account benefits.

- Fear of making mistakes: PKH beneficiaries were lacking in confidence and often depended on others to conduct transactions using their accounts.

- Lack of account ownership: General perception is that the PKH BRI account is owned by the government, not the beneficiaries, which will be closed once the program ends.

Our account activation solution

From our research, we mapped the customers’ complete journey to identify their needs, gaps and opportunities in every step of their journey, including the touch points. Customer research provided a great deal of insights, some of which were consistent with findings from our previous works on G2P beneficiaries and some of which were new. One interesting insight in particular was the lack of ownership over their PKH BRI account, among Irma and her friends

“The account was the government’s, not mine. So, if something happens with it, it is not my problem.” -Beneficiary, 34 years old, West Nusa Tenggara

Despite the fact that the PKH BRI accounts are being opened under each woman’s name with access provided via an ATM card, many women believe that they do not actually own the account, but rather the government does. Hence, they don’t worry about keeping their personal identification number (PIN) private (and in some cases, they share it with others) as they think that the account is only to receive the G2P payment. This misperception creates hesitancy among the women to use the account for their ‘personal’ financial transactions, even though they can benefit greatly from the expanded services.

To address these issues, we designed an all-encompassing solution aimed at changing women beneficiaries’ perception about account ownership, while also providing them with vital learning opportunities to improve their knowledge about the account and its benefits. Ultimately, our objective was to increase confidence and skills enabling women to conduct transactions independently, similar to our previous work. This paradigm shift regarding account ownership is expected to motivate women to engage more actively with their account. To this end, we developed two components to address the barrier of account ownership:

Certificate of Ownership, signed both by the beneficiaries and BRI staff, which serves as written confirmation of account ownership and enhances confidence in undertaking personal transactions.

Gamification of the account in the form of a Bingo-like game, called “Balap Bonus BRI.” It is designed to motivate women to complete a series of nine transactions on the PKH BRI account, after which they will receive rewards for completing. The goal of this gamification process is to build women beneficiaries’ confidence and comfort interacting with the PKH account by completing small tasks associated with transactions on their account.

The savings wallet is designed with a universal lock system that can only be opened by key holders to prevent beneficiaries from tapping into their savings. In this case, BRILink agents will be designated key holders.

To successfully deliver the entire solution, we identified and leveraged the existing ecosystem touch points along the women’s journey. Besides BRI’s staff, the solution leverages the , which are all with whom women beneficiaries have closer relationships and communications. In addition to directly targeting the women, the solution is also designed to these specific touch points with training pack and video education so they can serve and support women beneficiaries to use their account.

Future journey

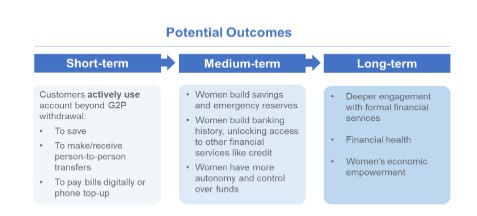

Since September, we have been implementing our account activation solution with select groups of BRI PKH beneficiaries and BRILink agents. While our solution focuses on improving account engagement, we expect that the solution will act as a starting point to shift women’s financial behaviors towards enhanced financial health and empowerment in the long run.

We look forward to sharing further updates on the program implementation and impact assessment in the coming months. We believe that the results could provide greater insights as to how we help G2P women beneficiaries achieve financial health by leveraging an existing trusted point in the infrastructure.

Women’s World Banking’s work with BRI is supported by the Bill & Melinda Gates Foundation.