By Whitney Mapes, Elwyn Panggabean, Angela Ang, and Agnes Salyanty

Over the past year and a half, Women’s World Banking has collaborated with Bank Negara Indonesia (BNI), one of the Indonesia’s largest state-owned banks involved in distributing benefits of the PKH (Program Keluarga Harapan or Family Hope Program), a conditional cash transfer program for low-income families, to develop an account activation solution for PKH beneficiaries. This project, implemented with support from the Ministry of Social Affairs (MoSA) of Indonesia, aims to build the capability of women PKH recipients to actively use their BNI accounts to grow their savings.

Together, we developed a holistic solution that helps PKH beneficiaries gain the knowledge, capabilities, and practical skills needed to save money within their BNI account and equips them with necessary financial tools to successfully build their savings behavior.

From January to March 2021, in partnership with BNI, we conducted a pilot of the solution across five villages in Bogor, West Java to evaluate how well it helps beneficiaries build their savings capacity. The pilot introduced the solution to 5 PKH facilitators and 25 peer group leaders through training sessions, who then shared it with over 1,200 PKH beneficiaries; among these, one-third of the beneficiaries received the full solution materials, while the remaining received more limited materials due to logistical constraints during Covid-19.

Solution impact on savings knowledge and behavior

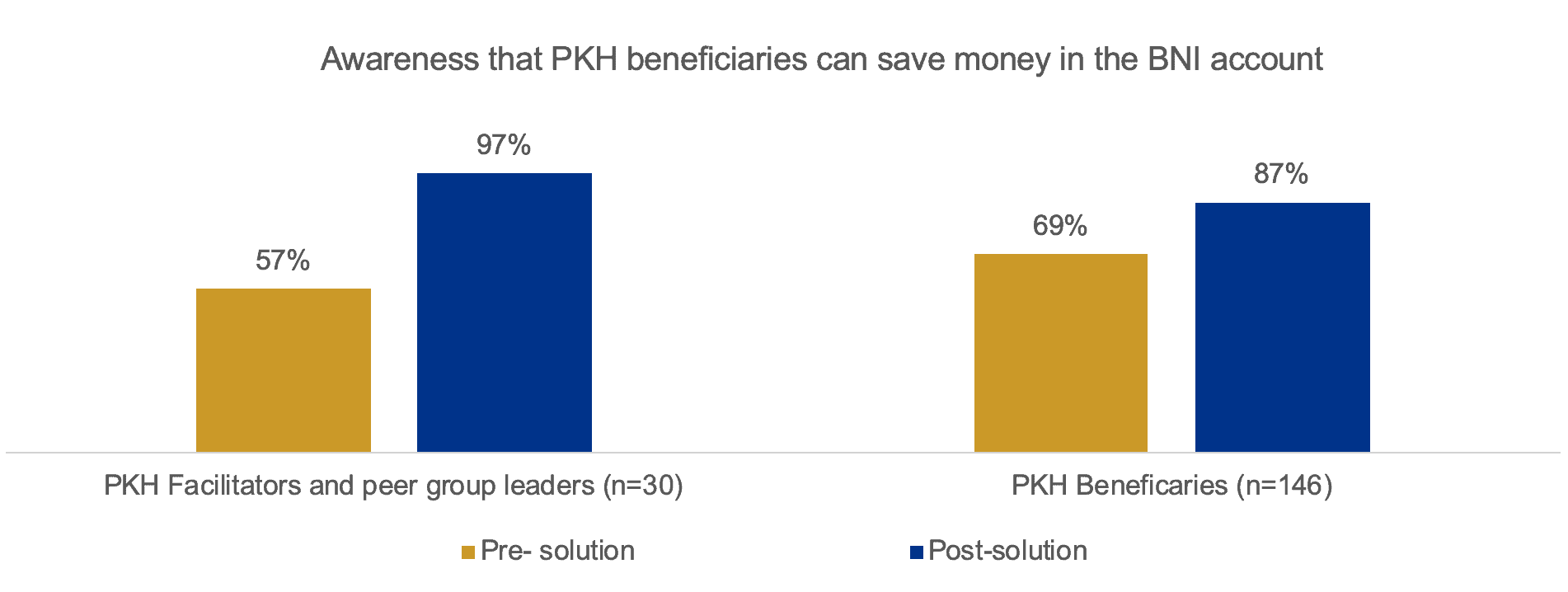

Despite challenges presented by the pandemic, the solution led to a significant knowledge shift among all pilot participants regarding their BNI account and its benefits (Figure 1).

A quantitative survey revealed that PKH Facilitators and Group Leaders, who are appointed as program ambassadors, increased dramatically (by 40 percentage points following the training) their knowledge of the ability to use the account to save money.

In addition, there was also a modest increase in beneficiaries’ understanding of how to use their BNI account for financial transactions beyond savings, such as remittances, phone top-ups, and bill payments. Consequently, nearly all PKH Beneficiaries (90%) expressed interest in using their BNI account to save, transfer and pay for their bills in the future.

These results suggest that the solution materials and training effectively increase the account knowledge of PKH Beneficiaries and program ambassador. This is particularly important due to travel restrictions and social distancing measures implemented due to Covid-19, so we expect an increase in digital transactions once beneficiaries become increasingly familiar with the account and how to use it.

During the pilot, beneficiaries have also made progress on starting to save and conduct other financial transactions (e.g., sending and receive money, bill payments, phone top-up). In two months, the number of beneficiaries who conducted at least one transaction tripled compared to their previous account activity, not including any transactions related to cashing out their PKH payment and system generated transactions. Similarly, the number of transactions performed by beneficiaries also tripled. This new behavior continues to trend upward and even increased in March when beneficiaries did not receive their PKH payment.

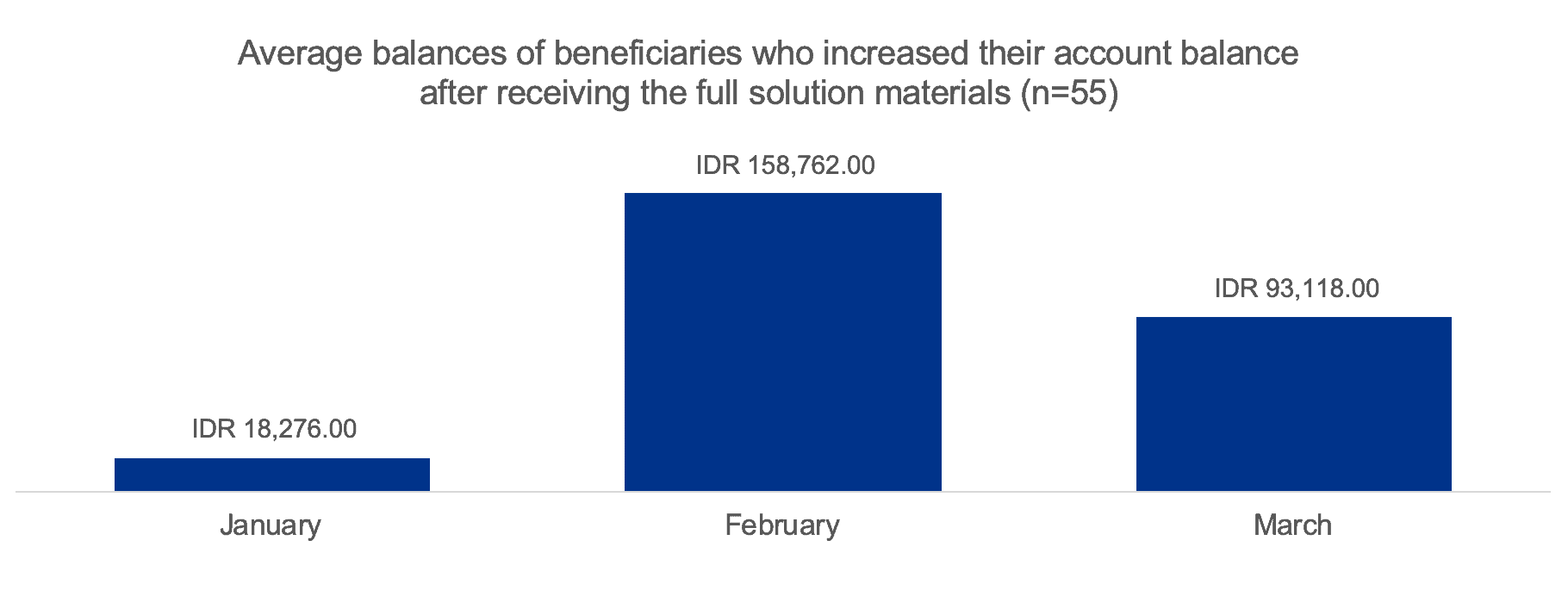

By the end of the pilot period, the number of beneficiaries who had savings in their account increased from 19 to 55. We found that 6% of beneficiaries increased the savings balance in their account by at least 10%, when the PKH disbursement was excluded. We also saw a significant increase of beneficiaries’ average savings balance from IDR18,276 ($1.26) to IDR93,118 ($6.41), exclusive of the PKH payment.

This suggests that the solution helps positively change the behavior of PKH beneficiaries to establish savings and broader account usage. Significantly, even among this group of low-income women, there is a recognition and desire to start and build capacity to save.

Key takeaways

While the solution successfully improved account knowledge and a change in savings behaviors, the pilot surfaced key lessons that will help us to improve and replicate the savings account activation solution and increase its long-term impact. This includes the following:

Lesson #1: In-person training is more effective for pilot participants

PKH beneficiaries face various challenges when participating in and comprehending remote training due to limited digital literacy, and environmental challenges that impact their ability to focus. To remedy these issues, we held a follow-up in-person, one-on-one training. Though this required more time and careful navigation due to restrictions on in-person gatherings, these 1:1 training sessions were more effective in communicating the solution and ensuring program ambassadors could pass the information on to PKH beneficiaries.

Lesson #2: Beneficiaries save more when their peer group leader acts as a savings role model

As compared to PKH facilitators, peer group leaders proved to be the more effective program ambassador. We also learned that peer group leaders’ own savings activity strongly influenced the savings behaviors of PKH beneficiaries, since women are more likely to start saving when they see their group leader also use her BNI account to save money.

Lesson #3: Beneficiaries’ literacy limits solution efficacy

The materials provided to explain the solution are most effective when distributed in full. However, the written solution materials are not effective for PKH beneficiaries who could not read or use these materials on their own, require more intensive guidance and support from their peer group leaders.

Lesson #4: Program incentives should give immediate rewards to balance long-term savings benefits

While PKH beneficiaries are motivated by cash rewards tied to the savings program, they found the requirements of the incentive structure complicated and disliked needing to wait until the end of the pilot to receive rewards. They are more interested in a simpler incentive scheme and cash rewards they can utilize immediately that serve to further motivate additional savings deposits.

Next steps and implications for the savings activation solution

As a next step, BNI plans to use the pilot results and lessons to rollout an adjusted solution to more PKH beneficiaries. Successful solution implementation will have positive impacts for both beneficiaries and the BNI business. The immediate benefit for beneficiaries is ensuring a means by which to build their savings, effectuate a new behavior and trust in digital services, and strengthen financial resilience. In the long run, we also estimate that this solution will empower and enhance the prosperity of PKH beneficiaries by enabling them to access other financial products and services. For the Bank, it also promises to generate greater revenue by growing customer loyalty, average account balances, transactions beyond cashing out their benefits, and corresponding increases in agents’ transactions and commissions.

Lastly, this collaboration has important implications for policy-makers on the effective future design of government support and subsidy programs. It is not sufficient to give beneficiaries an account; it is equally important to provide them with essential knowledge and strategies that build their capabilities and confidence to use financial tools made available and derive maximum benefits. Importantly, this solution is replicable for other FSPs who distribute the PKH or other similar G2P programs.

Women’s World Banking’s work with BNI is supported by the Australian Government through the Department of Foreign Affairs and Trade and the Caterpillar Foundation.