By Angela Ang, Elwyn Panggabean, Ker Thao, Nonggol Darapati

As the world shifts to living in a new normal world, while still recovering from the aftermath of the COVID-19 pandemic, no other shift has been greater than the shift from traditional economies to what is now known today as the gig economy.

COVID-19 created disproportionate impact to women, mainly as an impact in employers reducing their workforce at unprecedented rates around the world including Indonesia. As employers reduced their workforce, the economic impact in the labor market shifted as well, in particular, women’s livelihoods have changed. Women around the world either had to choose to continue working or caring for their families full time or have an extra burden for paid-work as well as do house work. Thanks to the advancement of technology, many women saw the opportunity to start their own business online, from the comforts of their homes.

Prior to COVID-19, the number of Ultra Micro Entrepreneurs in Indonesia (UMi) entrepreneurs using digital platforms in Indonesia was around eight million people. This number has nearly doubled to 15.9 million people since the start of the pandemic*. Now, more than ever, it is critical to harness the power of digital platforms for women’s economic empowerment.

Indonesia’s economy relies heavily on small-scale entrepreneurs. Micro, small, and medium-sized enterprises make up 61% of Indonesia’s economy, and the majority (64%) of these entrepreneurs are women. COVID-19’s particular economic challenges have pushed low-income people to entrepreneurship as the formal job market contracts.

Last year, BRI, Pegadaian, and Permodalan Nasional Madana (PNM) – a subsidiary of BRI, formed an Ultra Micro holding with BRI as the parent holding. PNM has an existing Ultra Micro customer base with their group-lending business model named Mekaar. BRI aims to improve financial literacy and lending penetration for at least 29 Million Ultra Micro customers by 2024. BRI also aims to have one million Ultra Micro customers graduate from the micro segment. As the new State owned Enterprise for Ultra Micro holding, BRI sees the Ultra Micro segment as a new source of growth engine in achieving their 2025 vision to be “The most Valuable Banking Group in Southeast Asia & Champion of Financial Inclusion.”

In order to gain an understanding of Ultra Micro Entrepreneurs in Indonesia (customers’ perspective and BRI’s Ultra Micro ecosystem, behavior, needs and interests, Women’s World Banking in cooperation with BRI conducted a research on UMi customers. The research was designed in mind with a specific aim to identify behavioral barriers that may exist for these entrepreneurs in accessing BRI’s micro finance products such as KECE (a loan product designed for the ultra-micro segment with the concept of ease and speed for of loan application process) and Simpedes UMi (a saving’s product which is very cost effective and has no minimum balance to maintain).

These three personas differ not only in their digital usage when it comes to their businesses but also in their motivation in starting their businesses. The Necessity entrepreneur started their business due to their income needs, the Stable entrepreneur ventured into their business to supplement their family income. While the Growth Oriented entrepreneur started their business to focus on a business and be successful. Despite the distinct differentiations between these three types of entrepreneurs, they share a similar trait in that when it comes to working capital, they all use informal lending and non-formal institutions as their working capital, whether it be through family, friends, or even their own savings.

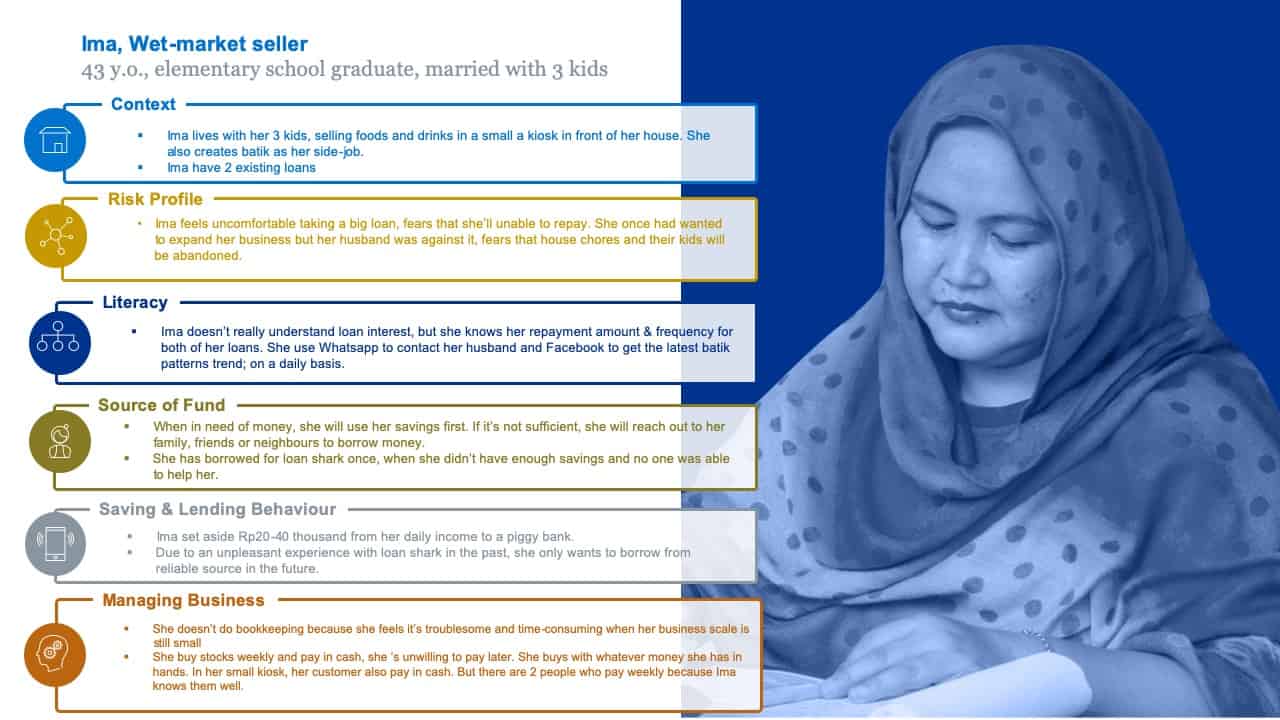

To gain a better understanding and illustrate of the needs of these Ultra Micro Entrepreneurs, Women’s World Banking has created a persona, Ima, a representation of a typical UMi customer, based on other the customers in the research study.

Ima, a wet-market seller, is a 43-year-old woman with a husband and three kids who owns a small kiosk in front of her house. She is an elementary school graduate and buys her backstock in cash on a weekly basis. She takes out a loan from family, friends, neighbors and not through a formal financial institution. In addition to her small kiosk where she sells small daily necessities such as soap, coffee, and other small daily consumable goods, Ima also creates batik (traditional Indonesian textiles featuring ornate geometric and floral patterns created by brushing or stamping hot wax onto undyed fabric) to gain extra income.

Ima’s position is similar to what the majority of UMi entrepreneurs currently face with limited financial educational background, being a parent and despite of having the ambition and drive to grow their business, their biggest obstacle also comes from their families. In Ima’s case it was her husband, who feared that by expanding her business and the kiosk, along with taking a bigger loan, Ima’s house chores and duties to her children would be neglected. For female UMi entrepreneurs, their biggest challenge for financial inclusion is having the freedom to be able to have access to financial products and services.

Ima’s limited financial education background has made her, and many like her, skeptical of formal financial institutions and in particular banks. Some of the perceptions that they had regarding banks and its usage was that savings had to be made in large amounts. Other skepticism revolved around uncertainties in using ATM machines and that the money saved in bank accounts would be reduced due to account fees.

“Withdrawing from the bank is complicated, if I die soon, I pity my family for not being able to withdraw money from the account.”

When it comes to loans, for the UMi entrepreneurs, their biggest fear was the inability to repay the loan. In addition to this, they also feared to take out the loan itself since they had never taken out a formal bank loan before. For many of these women, they chose to save in traditional methods such as saving in the form of gold or saving at home. Saving in the form of gold is popular in Southeast Asia, where for generations, it was seen as an “investment” that could either be pawned or sold when needed. It also stems from the belief that gold is a valuable metal that cannot be lost nor will it depreciate over time. But most importantly, the main reason for women to save in gold form is that it is considered accessible at any time and is convenient.

It is evident that the barriers for UMi entrepreneurs to be financially included lies with educating them on the banking process and products. In addition to educating these entrepreneurs, there is also a need to create tailor made products and solutions, which would bridge the gap between the customer’s knowledge, expectations and demands, along with the financial products that BRI currently offers its customers.

Women’s World Banking partnered with BRI to developed a solution to bridge the gap between the UMi entrepreneurs needs and the products offered by BRI to widen the financial inclusion reach to these entrepreneurs and the bank. The solution aims to expand access and understanding women ultra-micro entrepreneurs of financial products and services particularly savings and loan, as well as to empower key touch points for women (e.g. agents banking) to educate and offer financial products and services, resulting in greater usage of those services and greater women’s economic empowerment in the long run.

Stay tuned for part two where we delve into the challenges, solution, and outcomes for these Ultra Micro Entrepreneurs in Indonesia in their journey to enter the formal financial sector.