By Mehrdad (Mehi) Mirpourian, Senior Data Analyst, Research, Monitoring and Evaluation, at Women’s World Banking

“There have been as many plagues as wars in history; yet always plagues and wars take people equally by surprise.” – Albert Camus, The Plague

Introduction

Businesses function in environments that are agile and hard to predict in the best of times. During a pandemic, predicting the behavior of markets as well as the financial behavior of citizens is even more challenging.

For financial services providers (FSPs), the uncertainty and volatility of this global health crisis presents a particular challenge when it comes to their credit portfolios. To understand how FSPs are managing loans and maintaining their business during the Covid-19 outbreak, we conducted a quick survey intended to capture the realities of this specific moment in time. The survey questions focused mainly on the credit portfolios of FSPs with a low-income and micro-small-medium enterprise (MSME) customer base, and twelve survey respondents located in ten different countries.

A Brief on Survey Respondents

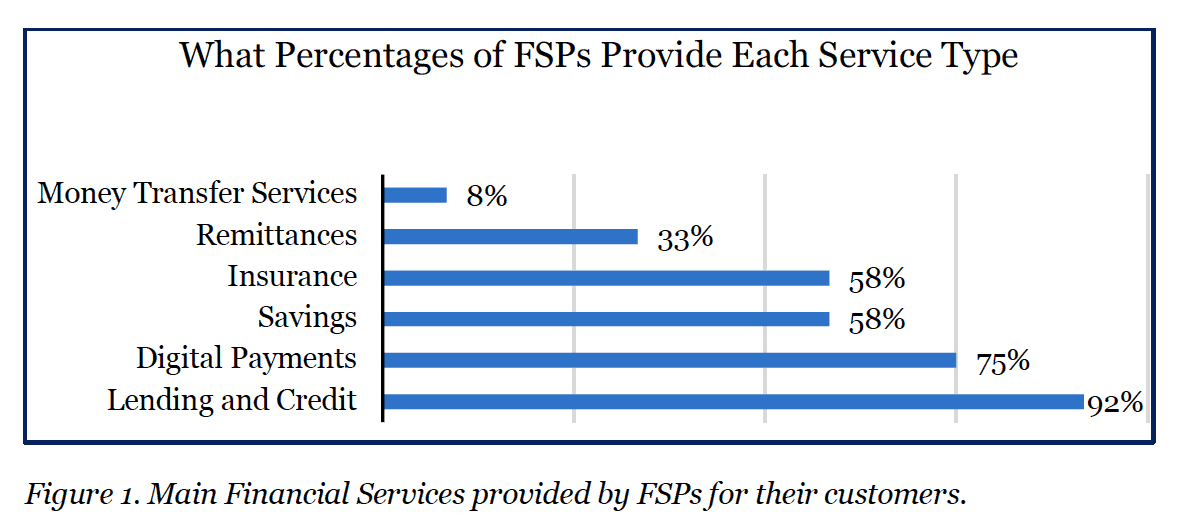

The Women’s World Banking Research Team conducted this survey with FSPs based in India, Cambodia, Jordan, Lebanon, Morocco, Egypt, Ethiopia, Nigeria, Senegal, and Uganda. More than 58% of the FSPs’ customers live in semi-urban areas, 25% in rural areas, and the remaining 17% in urban settings. The main financial services these FSPs provide for their customers are shown in Figure 1. As you can see, 92% of the survey respondents have lending and credit services, which is the main focus of this survey.

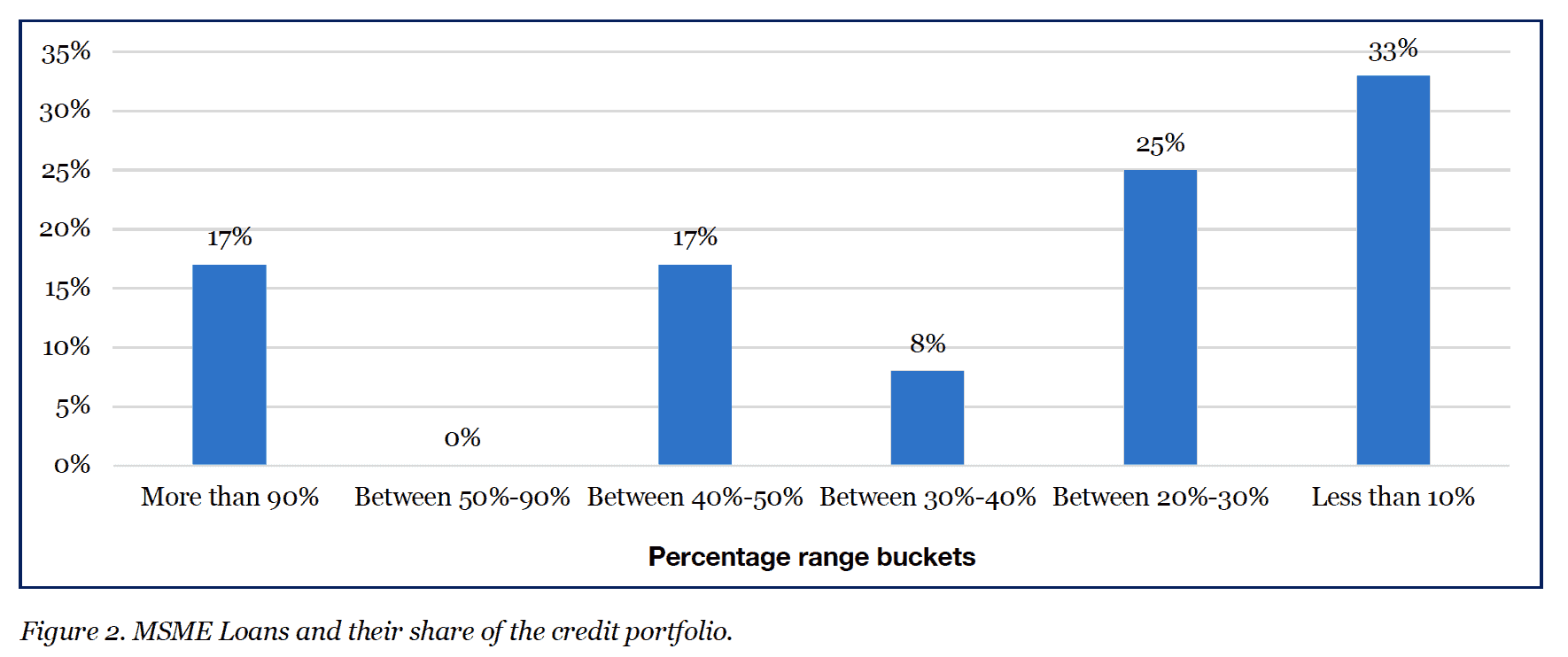

The credit services provided by these FSPs fall into three different types: individual loans, group loans, and MSME loans. Figure 2 shows what percentage of FSPs’ credit portfolios are based on MSME loans. We can see that on one end, 17% of FSPs reported that more than 90% of their credit portfolio is based on MSME loans. However on the other side of this spectrum, 33% said that less than 10% of their portfolio is based on MSME loans. This wide range shows different strategies that our survey respondent have in terms of the structure of their credit portfolio.

What follows is a summary of nine key takeaways from the survey, divided into the challenges faced by FSPs and their customers, and the ways in which FSPs are reacting to the situation. We then offer a brief overview of the learnings from the survey results.

Challenges Facing FSPs

1. Almost all of the FSPs that provide credit products (92% of survey respondents) have faced serious difficulties in loan collection and loan disbursement.

2. All of these FSPs are experiencing high default rates in loan repayments.

3. 58% of FSPs have faced administrative, operational, and logistical difficulties and malfunctions as a result of conditions including staff shortages, heavier workloads, closed offices, and the necessity of working from home.

Challenges Facing Customers

4. MSMEs overall have been significantly impacted by Covid-19, but the pandemic has affected various industries and sectors in different ways. Restaurants and services such as tailors and hairdressers have experienced the highest negative impact, followed by industrial and production manufacturers.

5. Applications for new loans among MSMEs have dropped by 67%.

How FSPs are Reacting

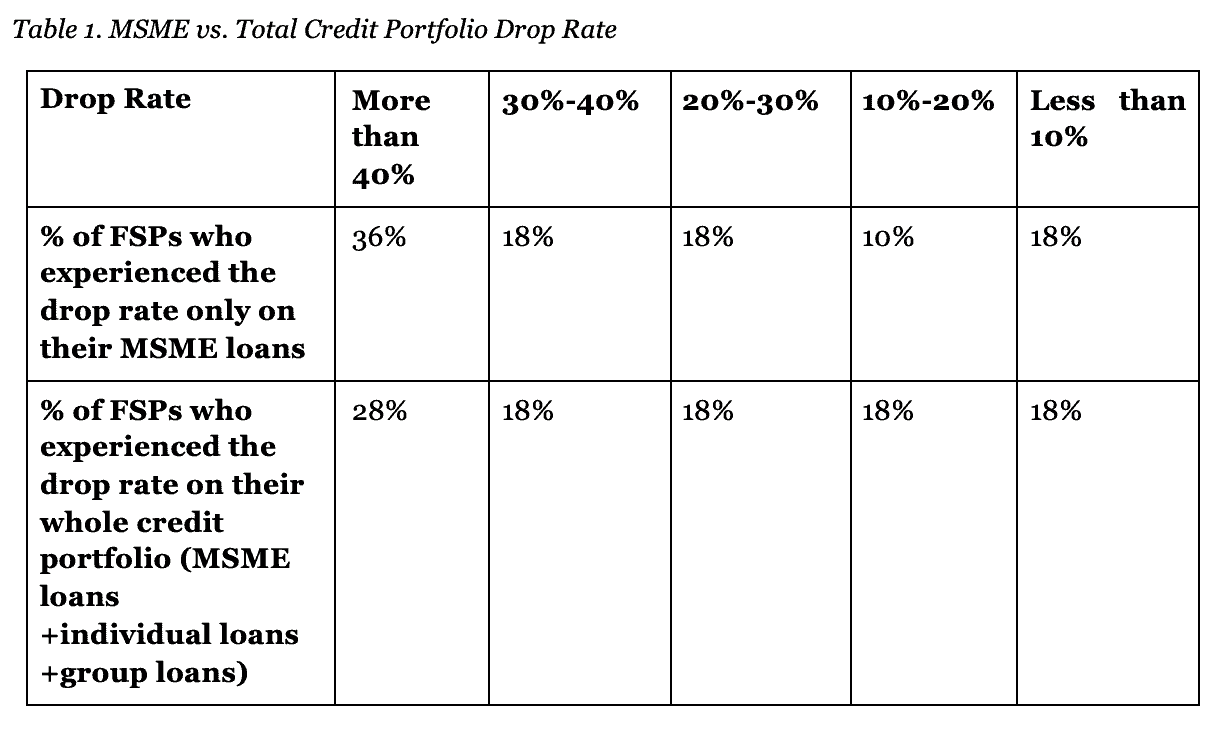

6. FSPs are having to adapt to a high drop rate for MSME loan repayments. Table 1 provides a summary of the drop rate for MSME loans in comparison to the whole credit portfolio of individual loans, group loans, and loans for MSMEs.

7. 17% of FSPs plan to drop their interest rates for loans, and the remaining 83% do not plan to change interest rates. At the same time, 50% of respondents said they plan to make the loan application process stricter.

8. 67% of FSPs say they plan to reschedule their own loan and payables repayments.

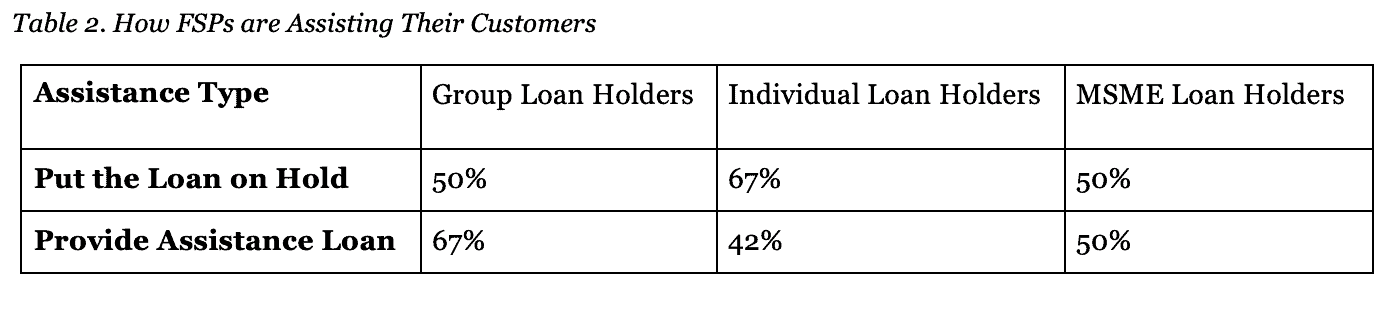

9. Some FSPs are putting customers’ loan repayments on hold, and some are providing assistance loans to segments of their credit portfolio. Table 2 provides a snapshot.

Opportunities and Threats

The pandemic has made it difficult for many loan recipients to pay back their loans, due to a sharp drop in their income stream. As some of our FSP respondents have found, when the supply chain breaks, women usually suffer more compared to men, and this is proving to be the case during the Covid-19 outbreak as well. However, establishing e-commerce platforms and online point of sales would help many businesses experience smaller losses.

Many FSPs mentioned that they would try to adapt financial technology at a faster pace after the Covid-19 pandemic, and transform many of their traditional activities into digital finance. This transformation will create huge opportunities for FSPs. During the Covid-19 pandemic, the need for financial services did not disappear and it was digital finance that met most of this demand. The shift towards digital finance can provide benefits at both micro-economic as well as macro-economic levels. Moving towards digital finance can make the access to finance easier and cheaper. In addition, it will remove barriers such as long commutes to banks that often cause low usage of official financial products. However, FSPs need to be cautious about the threats presented by this shift as well. It is necessary to consider that finance for low-income segment is traditionally based on a close connection between customers and FSPs. Loan officers create a bridge between an institution and its customers, and a healthy connection can bring many benefits for both parties. Loan officers provide a wide range of supporting services such as building customers’ financial literacy, motivating them to save, guiding them to choose the right credit product, and showing them how to use insurance to protect themselves and their families. Shifting all of these financial activities to online platforms and eliminating the important role of loan officers can drastically hurt FSPs and their low-income customers. As with many other technology adaptations, this transformation needs to be accomplished delicately and with deep consideration of its positive effects as well as its challenges.

For FSPs and for all enterprises doing business during the pandemic, it is clearer than ever that risk management and risk mitigation practices are not optional; they are critical for survival.

As the Albert Camus classic The Plague suggests, it is perhaps inevitable to be taken by surprise when the next overwhelming crisis happens. But it is vital to start preparing now, and to put best practices in place so we can prevail over any challenge that comes our way in the future.