Driving Women's Financial Inclusion at All Levels

Explore the latest global and regional insights from Women’s World Banking’s work in policy, leadership, women’s entrepreneurship, gender lens investing, and more.

Latest Posts

Making Finance Work for Women for 45 Years | Dr. Jennifer Riria

To celebrate Women’s World Banking’s 45th anniversary, we are showcasing the voices of individuals from around the world who have shaped and touched Women’s World Banking journey. These are stories from across Women’s World Banking’s reach from the women we serve and our customers, to allies and women in leadership

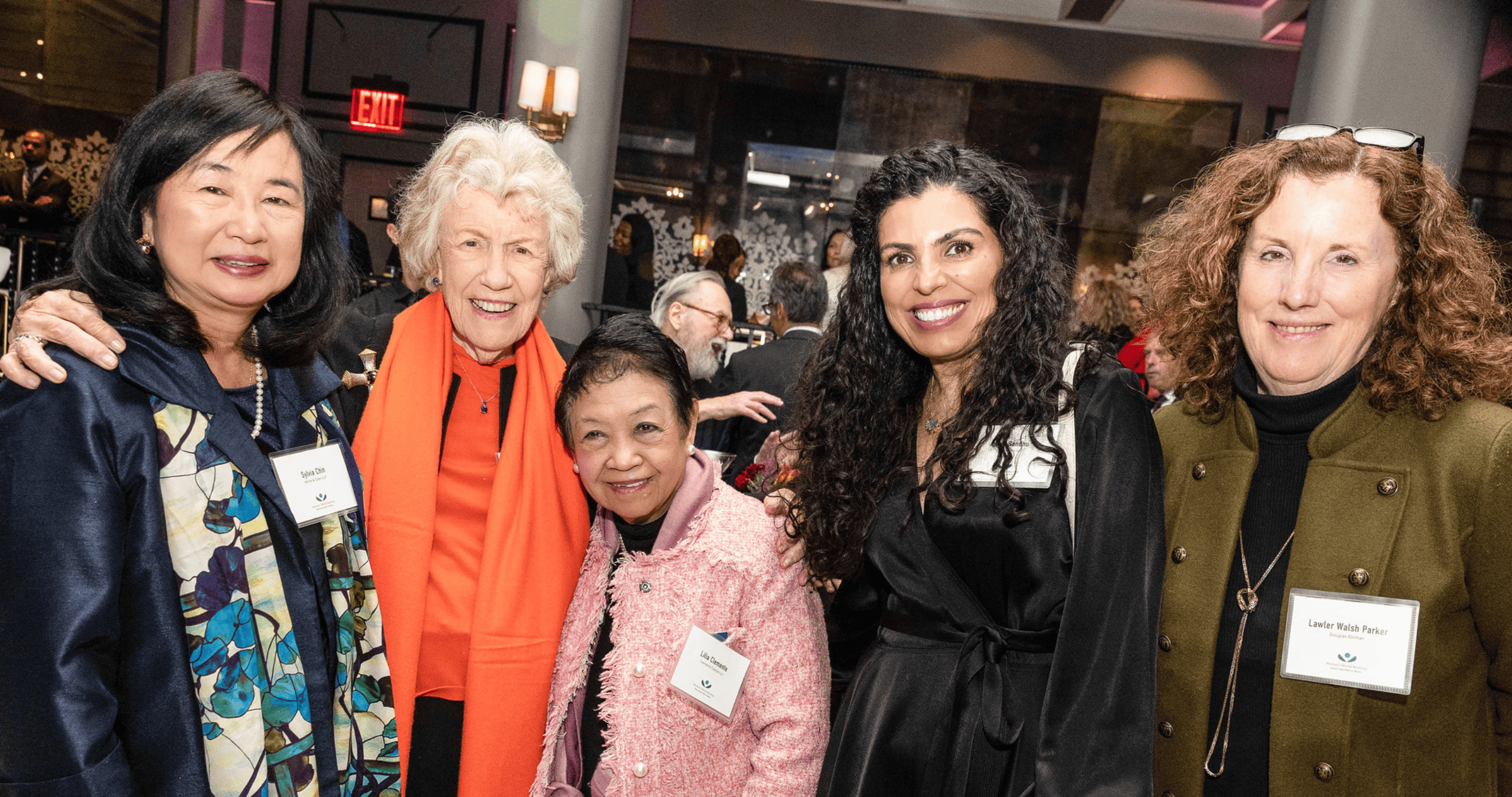

Making Finance Work for Women for 45 Years | Sylvia Chin

To celebrate Women’s World Banking’s (WWB) 45th anniversary, we are showcasing the voices of individuals from around the world who have shaped and touched Women’s World Banking journey. These are stories from across Women’s World Banking’s reach from the women we serve and our customers, to allies and women in

Charting Paths to Empowerment: Highlights from the Women’s Digital Financial Inclusion Advocacy Hub

The Women’s Digital Financial Inclusion (WDFI) Advocacy Hub team recently met with coalition members and the larger women’s financial inclusion ecosystem in Addis Ababa. Ethiopia is home to one of the local coalitions, and two coalition members joined from Indonesia, home to the other local coalition (Dr. Arifah Rahmawati, Secretary

The MFWW Podcast Ep. 9: Past to Present: Women’s Role in Fintech’s Evolution

In episode 9 of The Making Finance Work for Women Podcast, we embark on a compelling exploration of the evolution of fintech, recognizing the pivotal yet underrepresented role of women leaders in this burgeoning industry. As fintech matures, it is crucial to acknowledge the responsibility that accompanies its growth.

Five Insights to Drive Digital Inclusion of Women

By Dr. Sonja Kelly, Global Vice President, Research & Advocacy, Women’s World Banking The early release of the GSMA Mobile Gender Gap 2024 headlines, the World Bank Global Digital Summit, and the preparations for Brazil’s G20 focus on digital identity and data governance converged this past week, with important insights

Making Finance Work for Women for 45 Years | Blanca Estela Olvera

To celebrate Women’s World Banking’s 45th anniversary, we are showcasing the voices of individuals from around the world who have shaped and touched Women’s World Banking journey since its inception in 1979 at Commission on the Status of Women till today! These are stories from across Women’s World Banking’s reach

Making Finance Work for Women for 45 Years | Michaela Walsh

An unchartered path always held an allure for her. While it was unusual for a girl from Kansas City to go to college on the East Coast in the 50’s, she took the risk anyway. After her freshman year at Manhattanville College in 1952, she jumpstarted her career and secured

The MFWW Podcast Ep. 8: Two Sides of the Crypto Coin & the Promise of Financial Inclusion

In episode 8 of Making Finance Work for Women, we delve into cryptocurrency’s potential for financial inclusion. Explore its promises and challenges, from decentralization to market volatility. Join Sonja Kelly and Sheila Warren as they discuss whether crypto can bridge economic gaps or faces fundamental obstacles.

A Year in the WDFI Advocacy Hub: Driving Momentum for Women’s Digital Financial Inclusion

The Women’s Digital Financial Inclusion (WDFI) Advocacy Hub, launched in July 2022, is a catalyst for collective action joining together public and private sector organizations to accelerate progress in women’s digital financial inclusion. At the start of 2024, we are looking back at our first full year and the progress

The MFWW Podcast Ep. 7: Insider Insights: Financial Inclusion in 2023 and Shaping Forces for 2024

Sonja Kelly from Women’s World Banking and Leora Klapper from the World Bank highlight global progress made by fintechs, regulators, and others in financial inclusion. They also provide insights on anticipated developments in the finance ecosystem for 2024. Tune in to Women’s World Banking’s Making Finance Work for Women (MFWW) Podcast for expert discussions on transformative finance solutions.