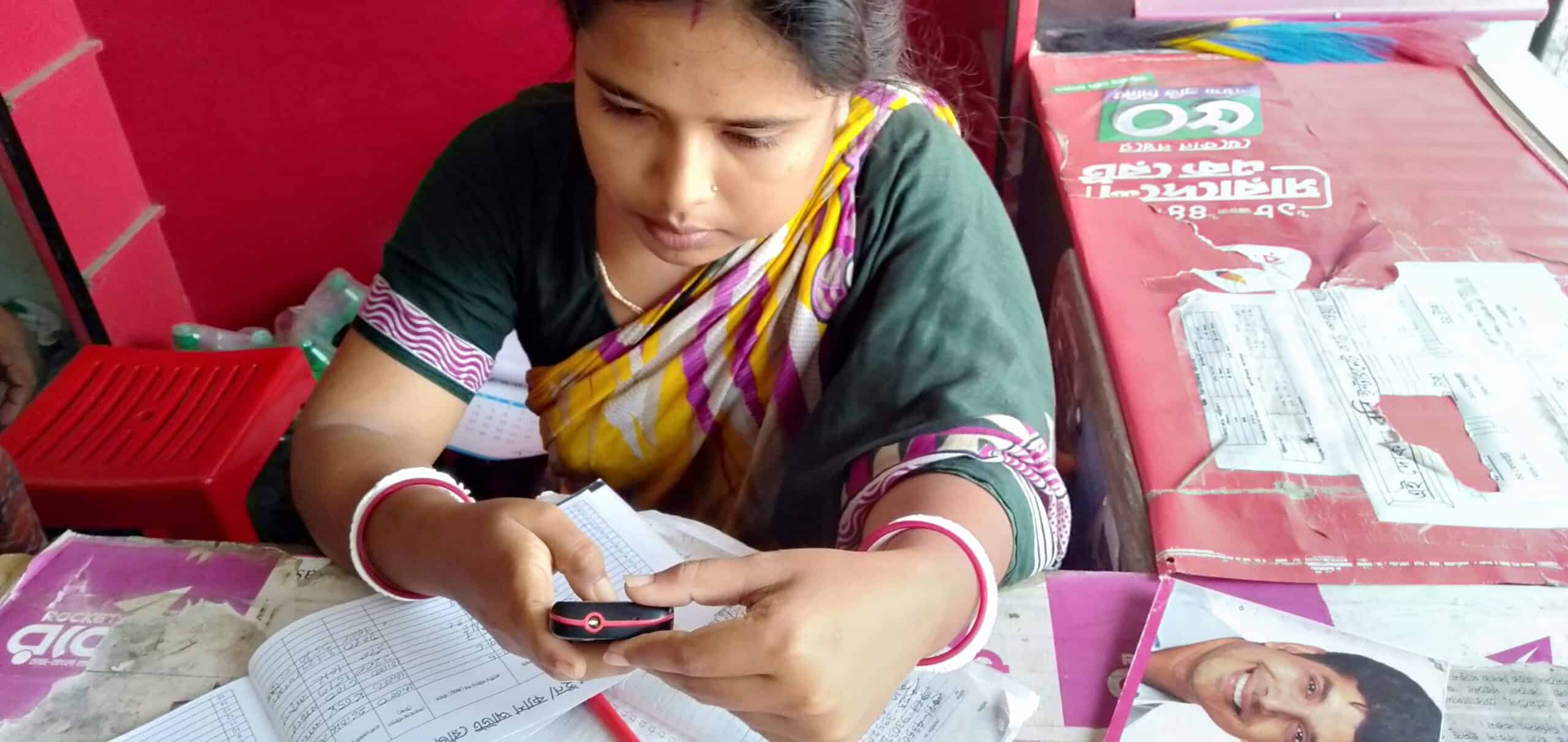

Insights: Empowering Women Domestic Workers with Digital Wallets

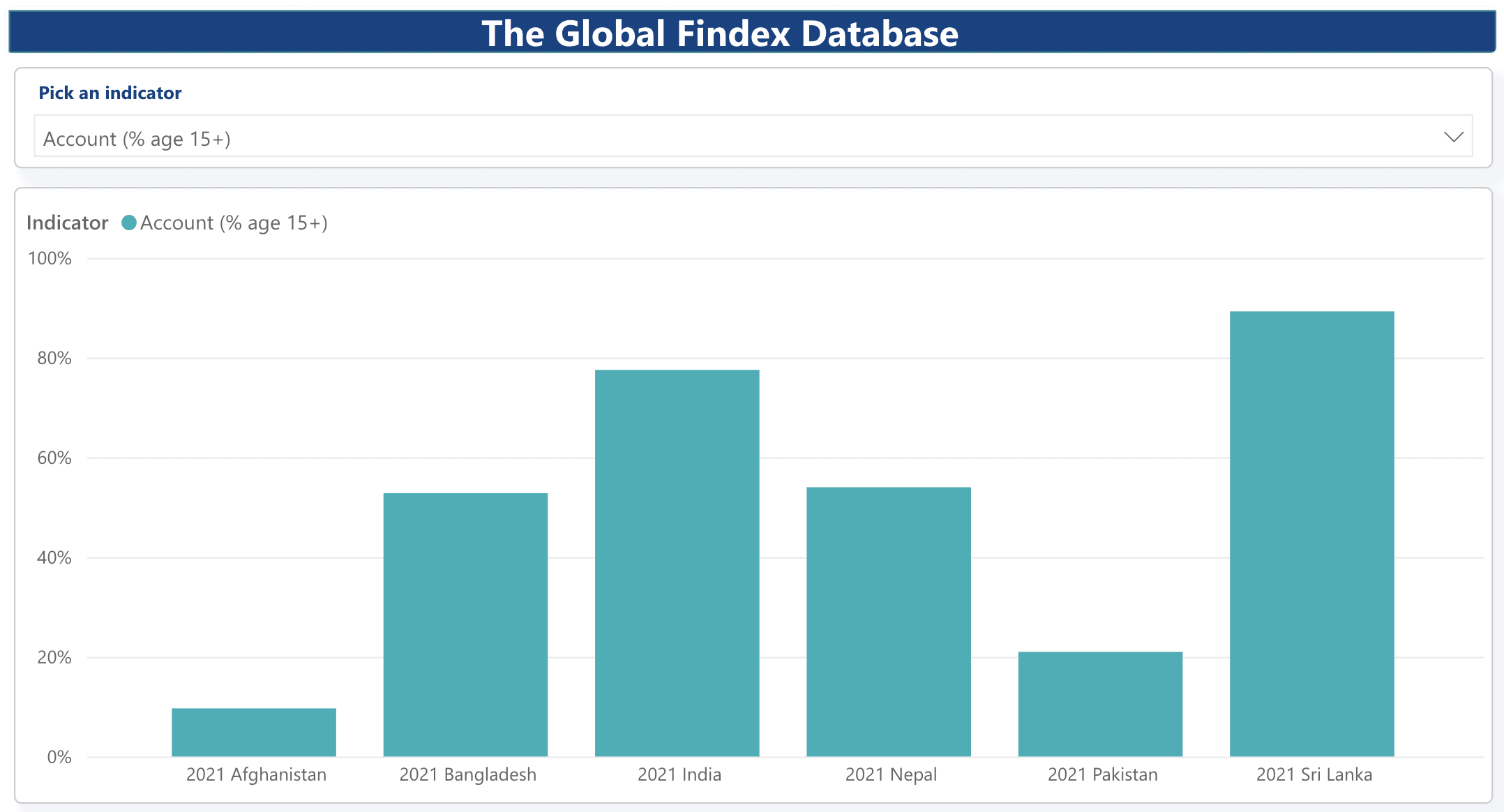

Globally, 76.2% of the 75.6 million domestic workers are women. In Indonesia, approximately five million domestic workers, mostly from rural areas, migrate to urban centers, often working long hours and earning below the legal minimum wage. Despite their critical role in the economy, they remain largely marginalized from formal financial