The Savings Mobilization Replication Toolkit

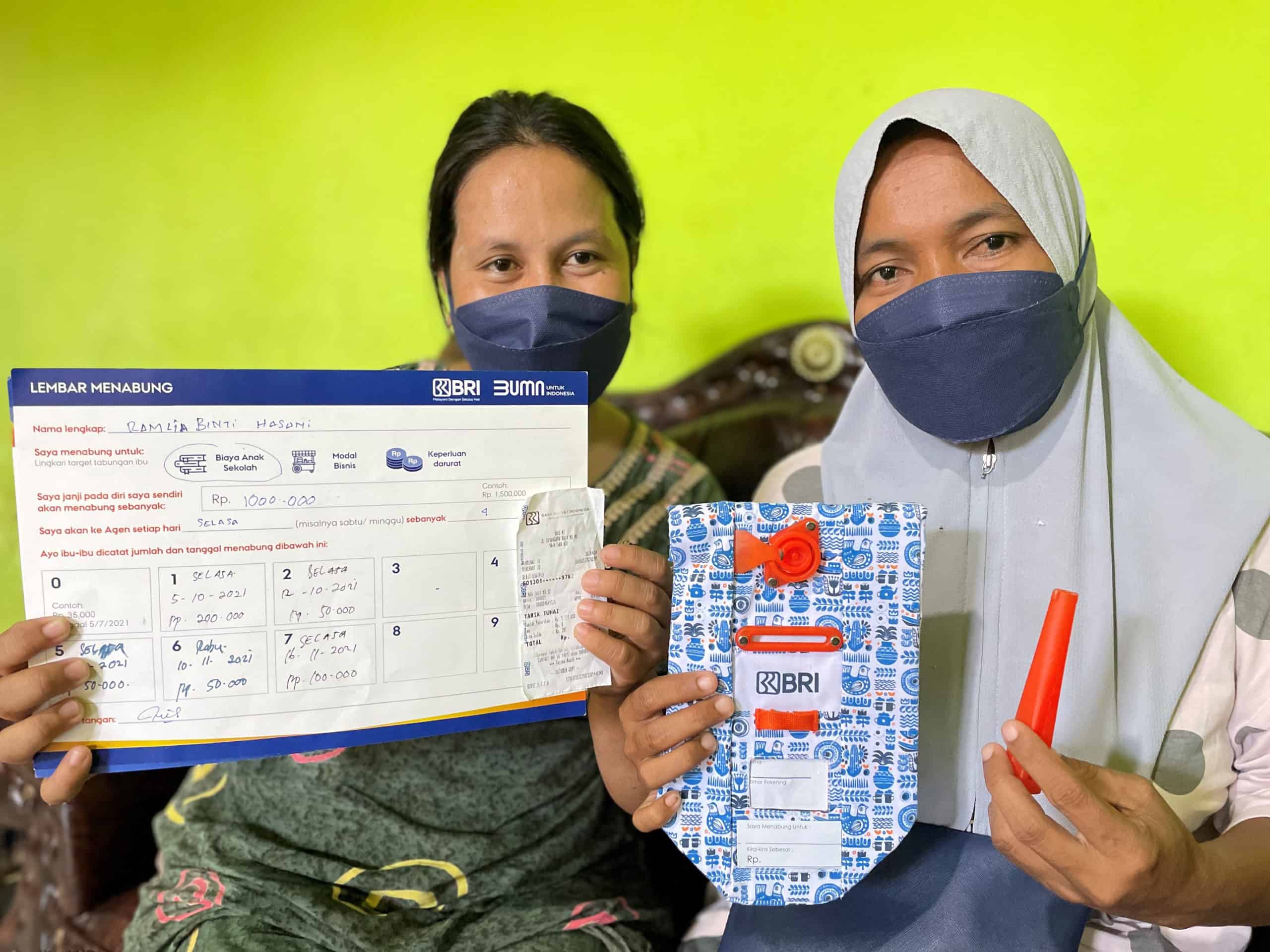

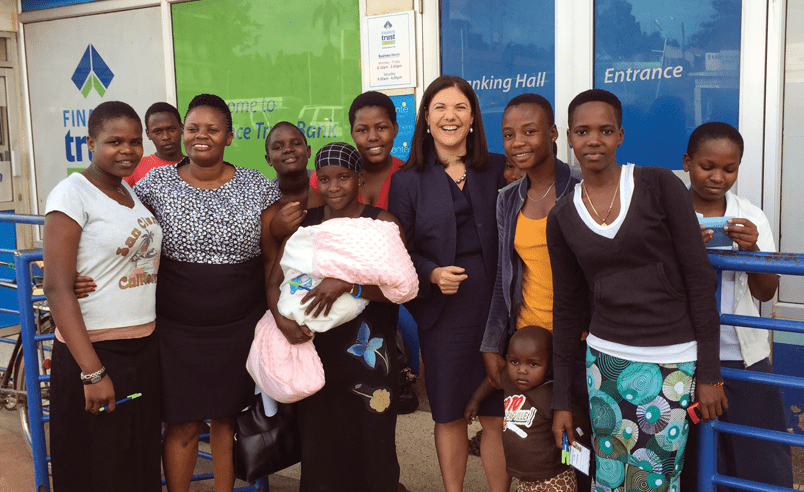

Few financial products and services are developed with the needs of the low-income woman customer in mind or account for the challenges that a low-income woman might face. Many financial products are not set up to sustain the continued interaction required to create the trust that the low-income woman needs