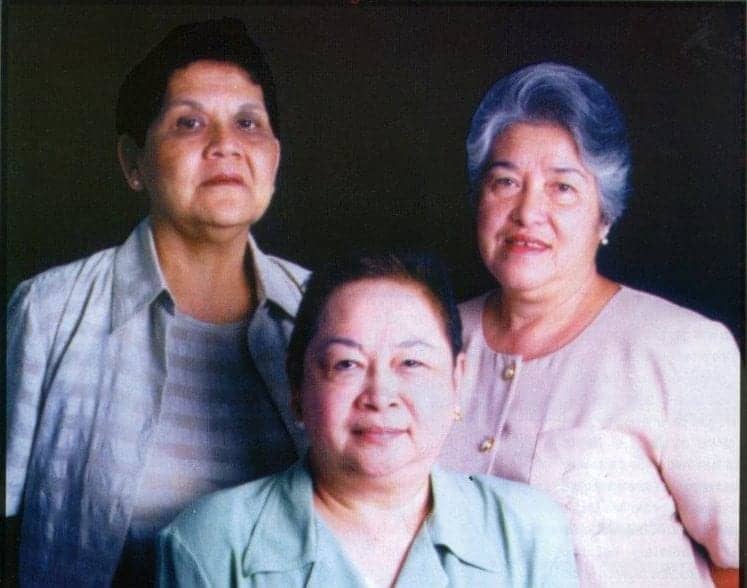

Making Finance Work for Women for 45 Years | Sar Yorn

To celebrate Women’s World Banking’s 45th anniversary, we are showcasing the voices of individuals from around the world who have shaped and touched Women’s World Banking journey since its inception in 1979 at Commission on the Status of Women to today! These are stories from across Women’s World Banking’s reach