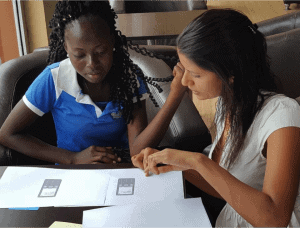

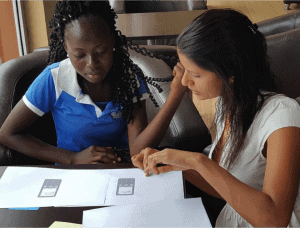

September 23, 2013 Women’s World Banking had the privilege of participating in a collaborative workshop in Port Moresby, co-hosted by the Central Bank of Papua New Guinea (PNG) and the UNCDF Pacific Financial Inclusion Programme (PFIP), intended to generate ideas from a range of stakeholders to include in the strategy. This gave us a unique opportunity to utilize our research on the challenges and opportunities women face in accessing financial services in PNG to influence national policy, ensure that it includes a focus on women and to continue building our relationships with players in the Pacific region following our regional forum earlier this year.

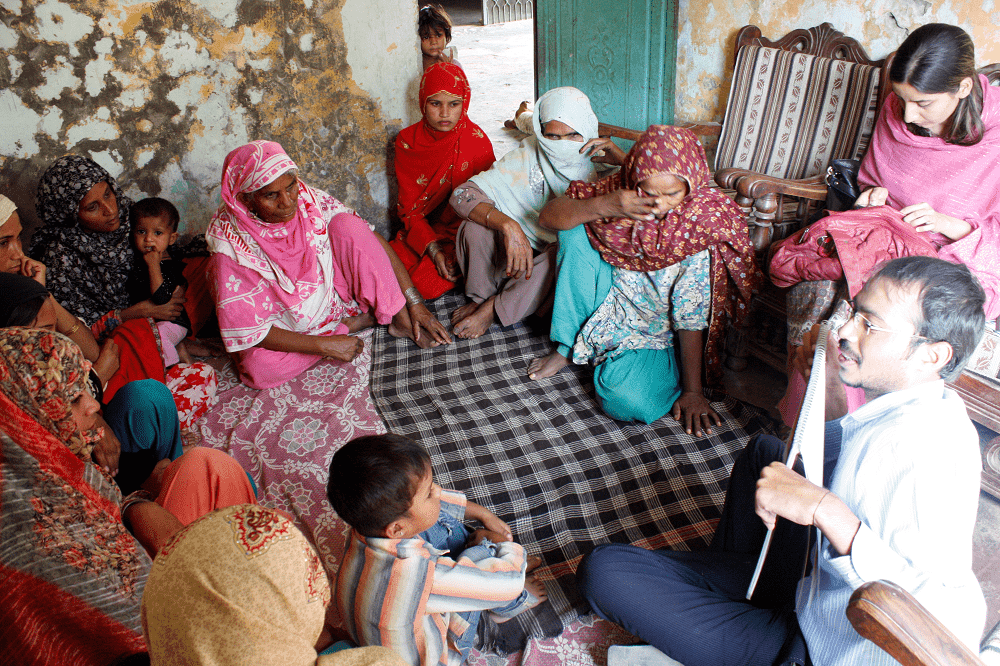

It was heartening to see a Central Bank choosing to call together a diverse and mostly-local group of bankers, microfinance practitioners, women’s groups and representatives from savings and loan societies – alongside Women’s World Banking and the International Finance Corporation – to gather their perspectives on what the national strategy should look like. Each group presented their point of view and produced at the end of the workshop, a summary of recommendations that featured a wide range of opinions and targeting different constituencies.

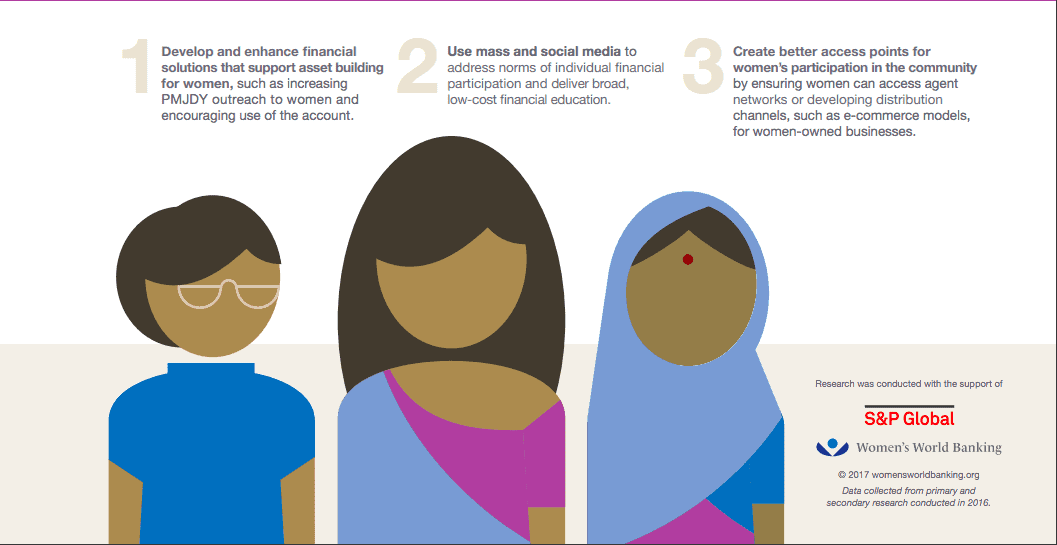

We highlighted these key points from our research:

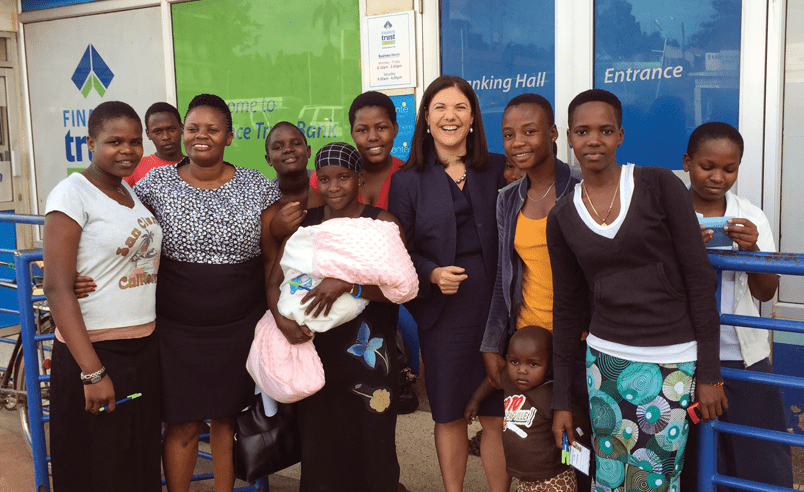

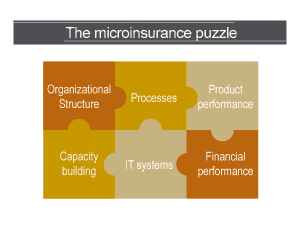

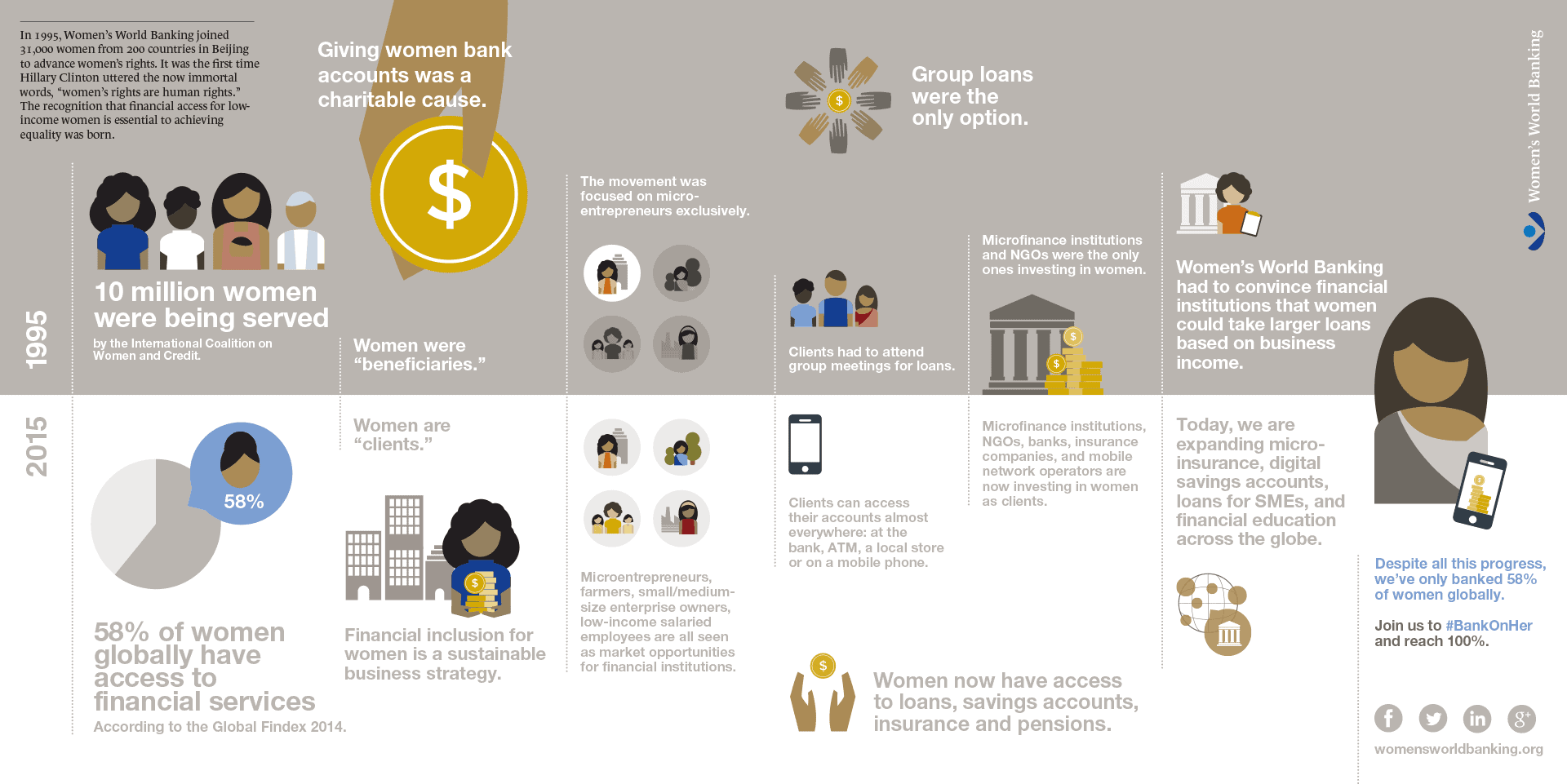

• There is an immense opportunity to serve women in PNG. Women are dramatically underserved by the financial services sector yet are just as likely as men to be earning. Women are important contributors to household. Our research showed that women need and want services to help them manage their money, including savings, loans and micro-insurance. Financial services providers should see serving women as not just a social cause but a real business opportunity.

• But women are tough customers. Winning the loyalty of PNG’s unbanked women will not be easy. Our research shows that to satisfy women, banking services need to be:

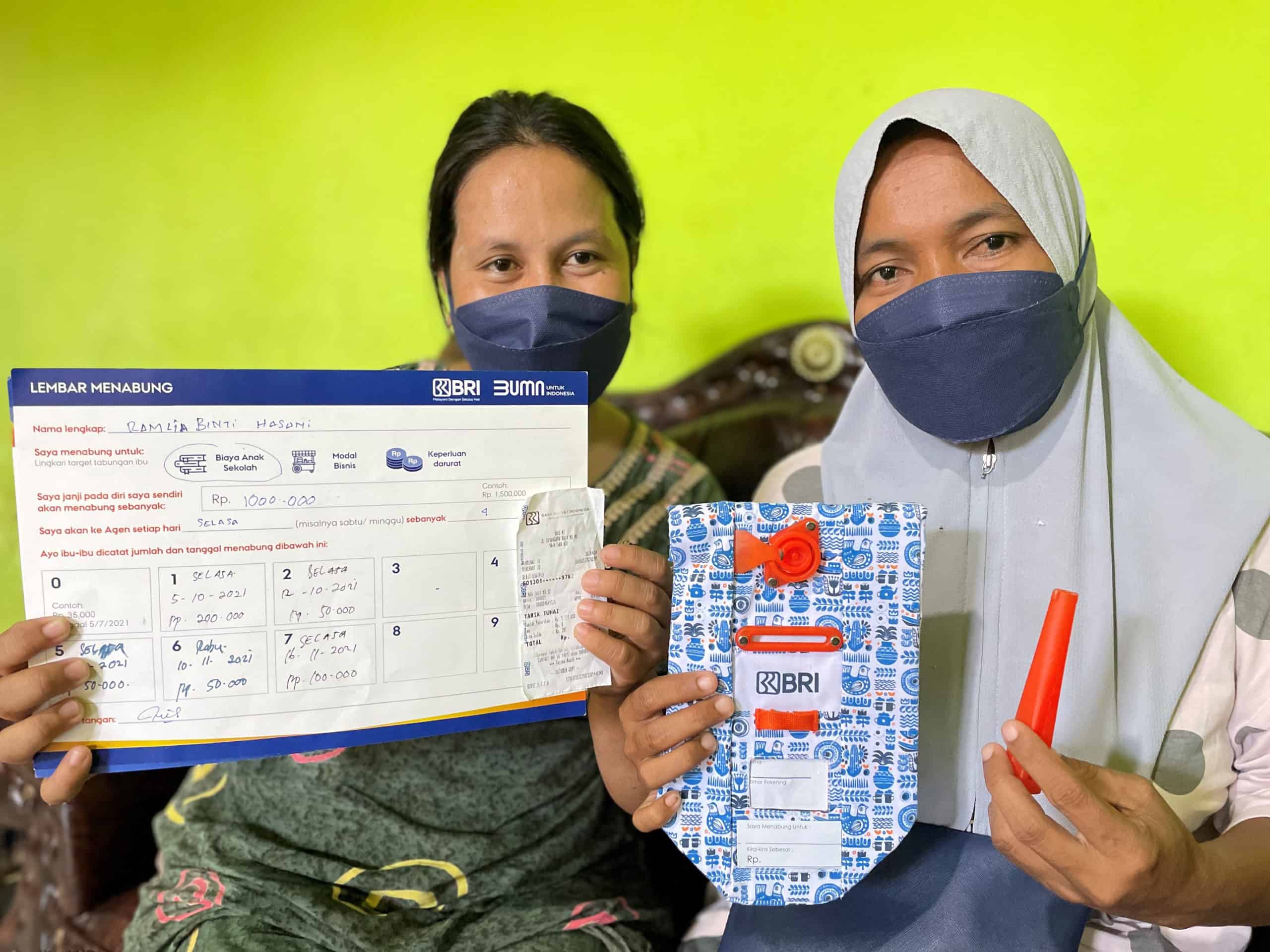

• Affordable and transparent: Women in PNG and elsewhere are unwilling to pay fees to save, such as the account maintenance fees and heavy withdrawal fees common in PNG. These fees effectively impact women more than men because they are usually poorer and have the responsibility of stretching their income to cover household expenses. Low fee, “no frills” accounts are offered by all of the PNG banks, yet there seem to be gaps in the outreach and awareness of these accounts. Most women in our study only knew about fee-based accounts.

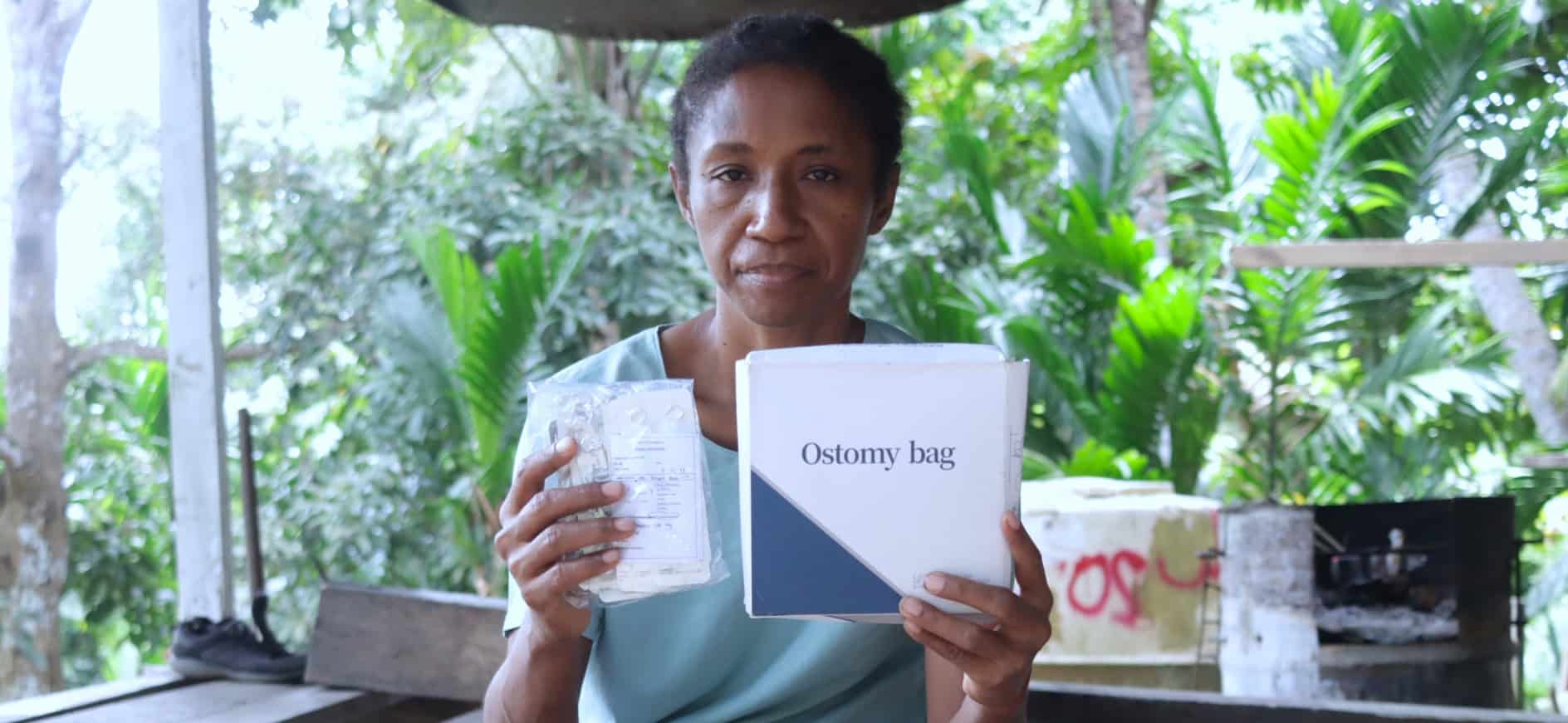

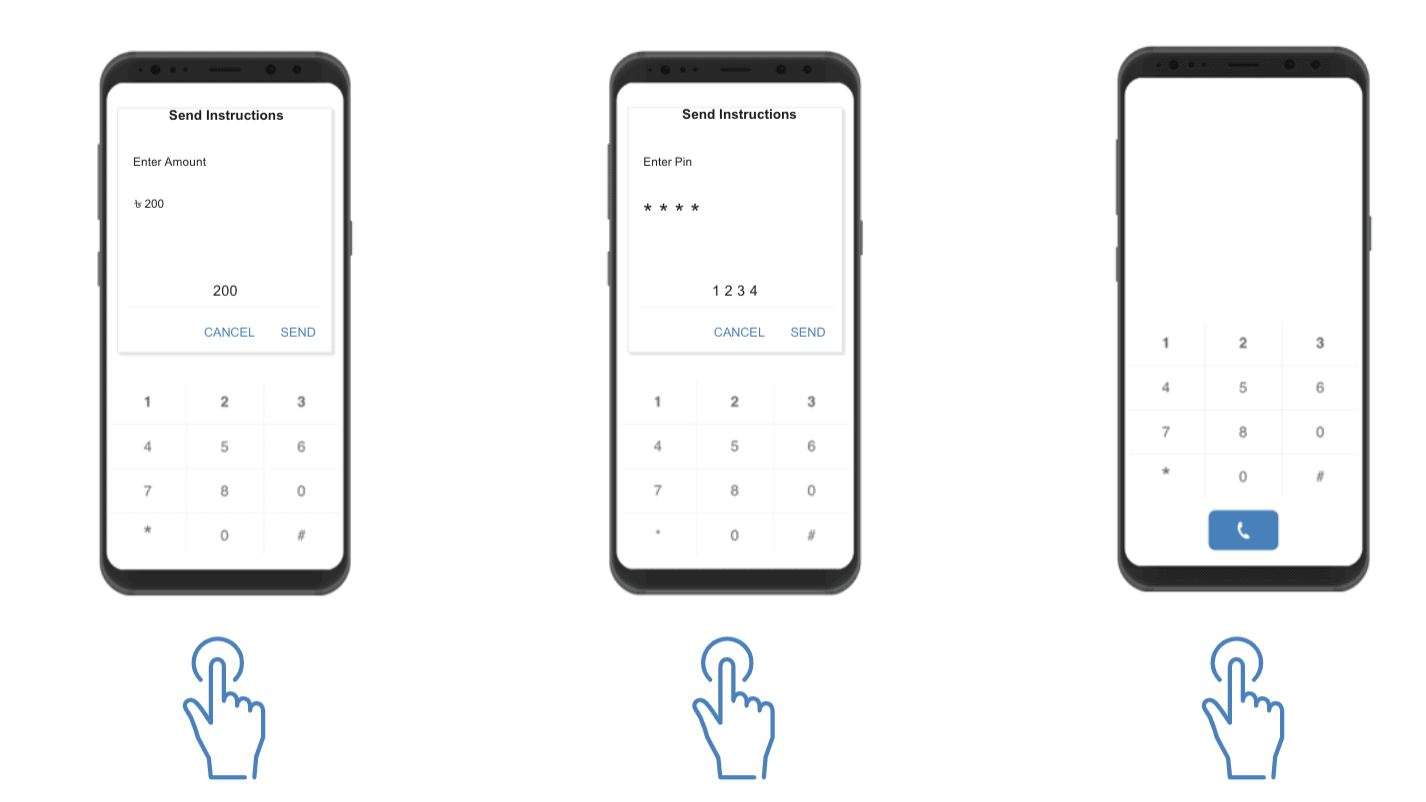

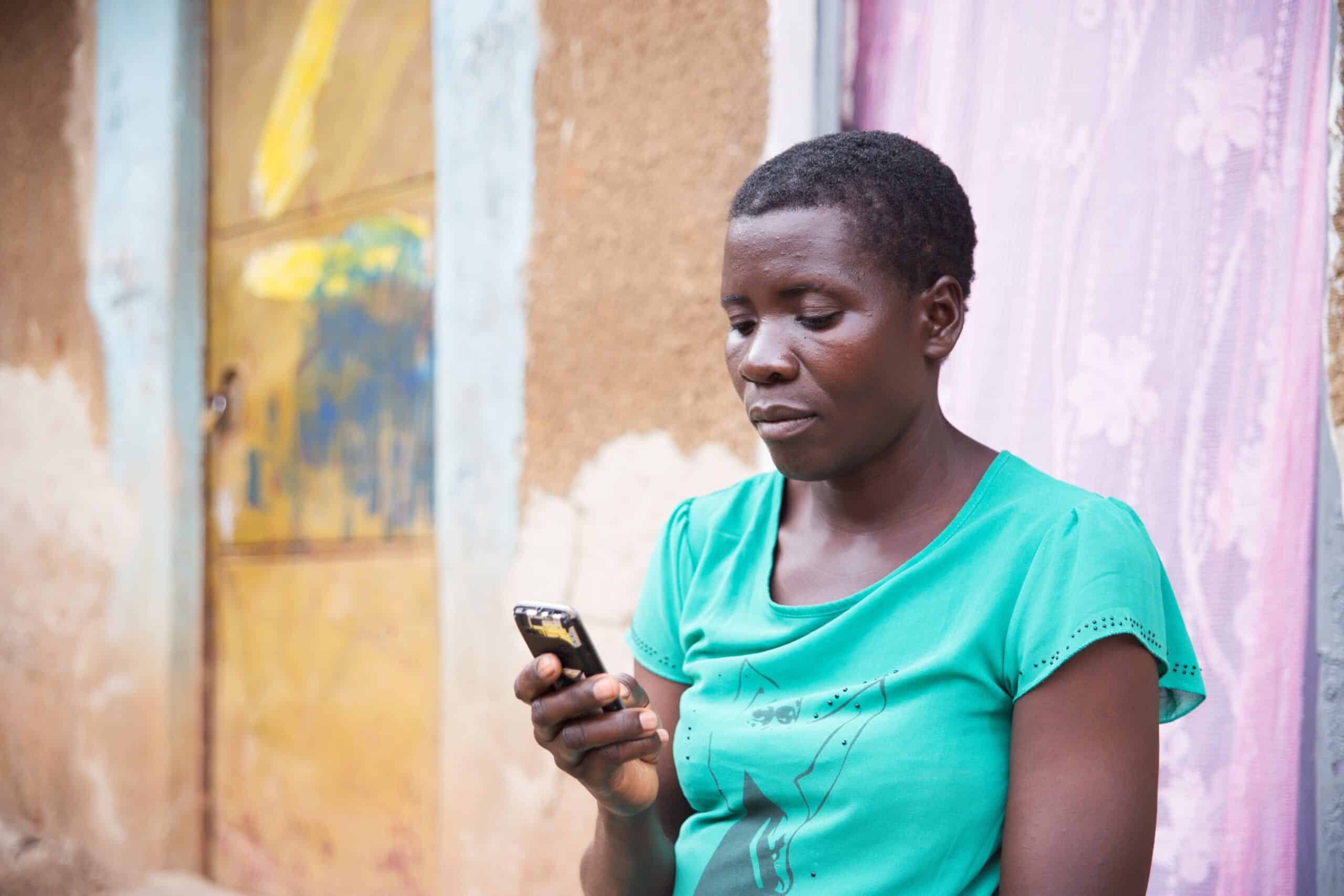

• Secure: Women repeatedly emphasized PNG’s weak law and order environment and extremely high rates of domestic violence, which both pose serious risks for women’s physical well-being and their money if it is not locked away securely. Women also highlighted the risks of carrying money to and from their homes and businesses and said that carrying money to a bank branch may also not be safe. Mobile phone banking through neighborhood agents is therefore an attractive solution.

• Convenient: Working mothers everywhere know that they are the busiest people in the world! It’s no different in PNG. Mobile phone banking is not only great for security but offers a way to make banking much more convenient. But there is a gender gap in terms of access: PFIP found that 21% of women in urban areas do not have a phone, compared to just 9% of men. There’s also room to improve understanding and trust of mobile phone banking amongst women. GSMA found that 47% of women liked the idea but did not open a mobile money account because they didn’t understand the technology and 55% were not sure if mobile money is safe.

• Easy for illiterate customers: English is the language of the financial sector in PNG and many places, yet many women in Port Moresby (nearly 75% according to PFIP) are unable to communicate in English (a figure likely to be higher in rural and remote areas). Women’s World Banking believes in using visual and vernacular languages when creating marketing materials and forms to reduce this barrier.

The good news is that these are the features that both women and men want. If banks find ways to satisfy women through incorporating more of the features above, they will also gain men customers who have similarly been excluded from the banking sector.

Women’s World Banking shared these insights with the Central Bank, urging them to set targets to balance financial inclusion in PNG and to encourage more inclusive product design. The following inputs to the strategy were made, relating to a focus on women of the Central Bank:

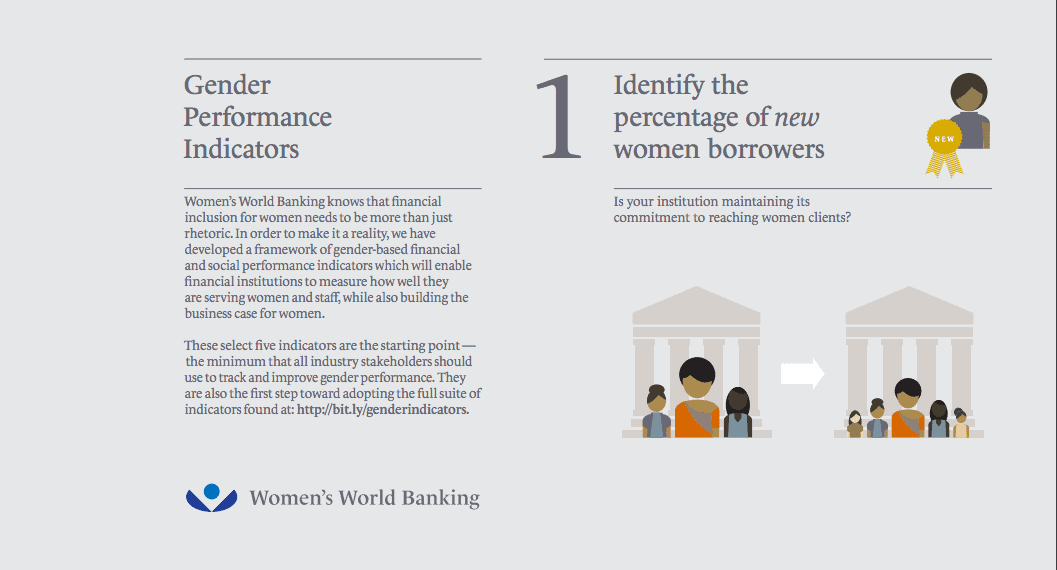

• Set a target of 50% women served by the financial services sector, up from 30%, by 2015. Individual institutions should identify institutional targets for women’s financial inclusion and disaggregate gender data to track their progress.

• Lower the documentation requirements for opening an account (a barrier for women who do not have ID cards). This could include allowing women to use their affiliation with member-based groups, such as the Women’s Coffee Growers’ Association for example, as proof of identification for basic accounts.

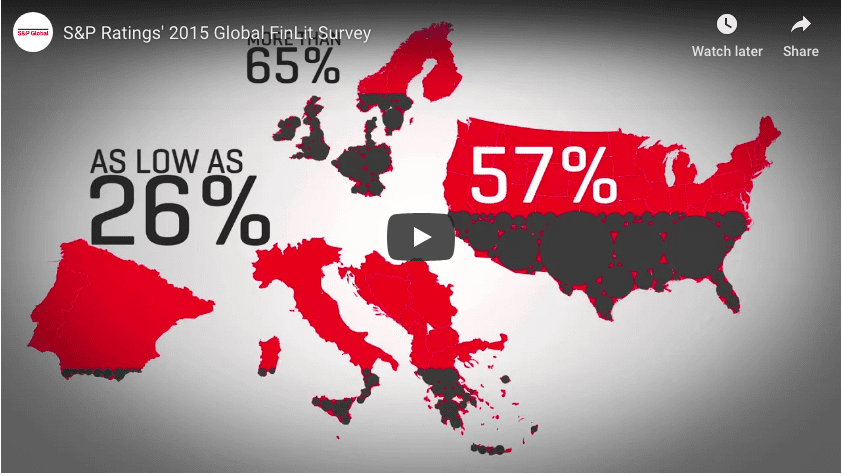

• Work with the Ministry of Education to include financial education in the curriculum of public schools or vocational institutions, as an effort to start building financial literacy at a younger age to prepare more girls (and boys) to use financial services.

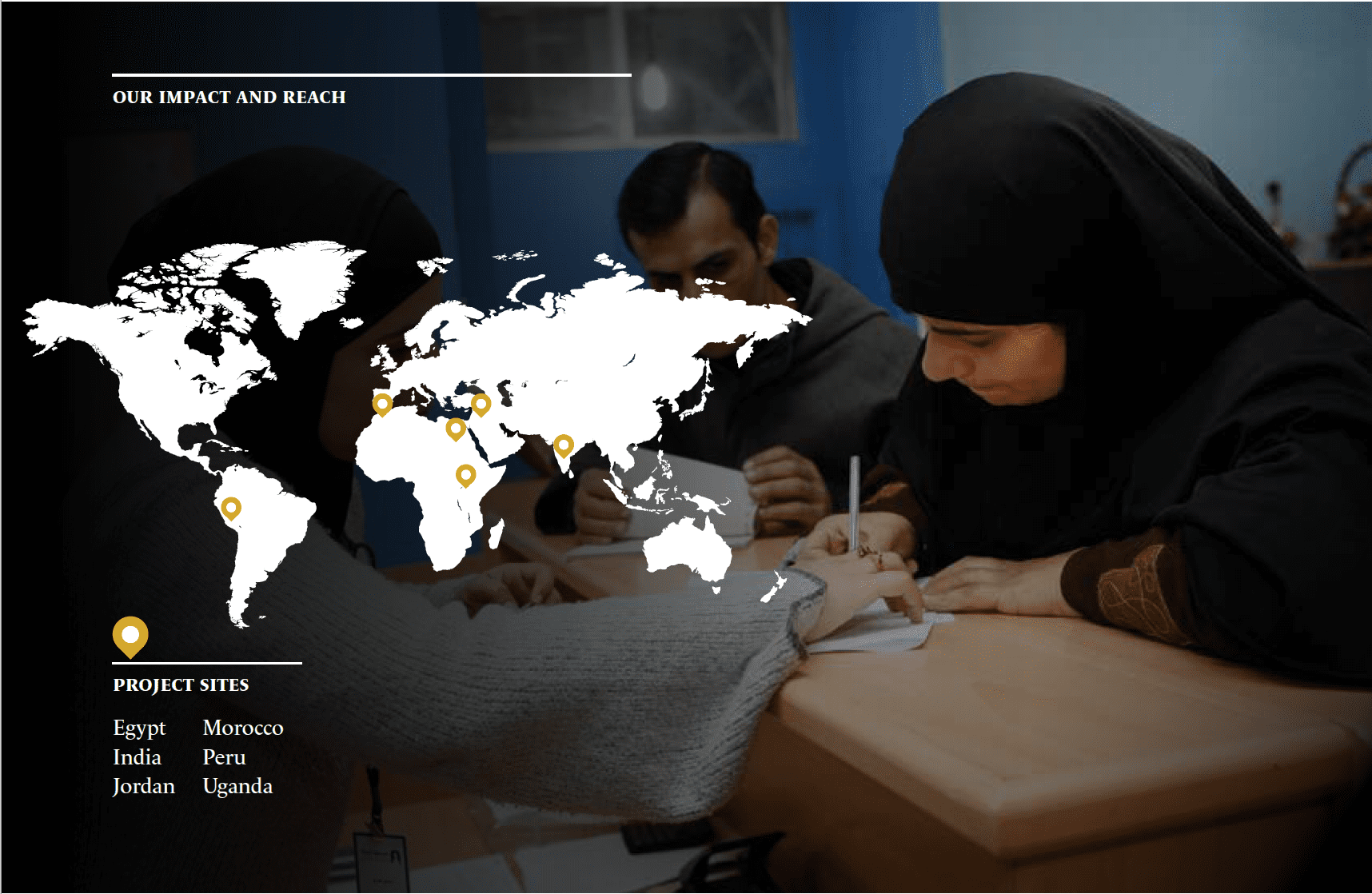

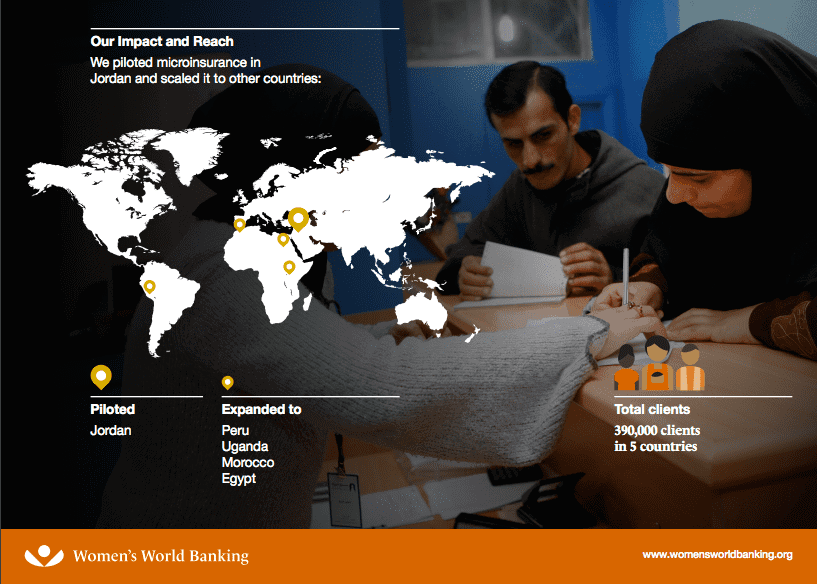

Women’s World Banking was proud to be able to contribute to and hopefully influence PNG’s national financial inclusion strategy. We’ll continue to look out for gains in women’s access in region, as we work on expanding financial inclusion for women around the world.